Fixed Rates

30 yr

25 yr

20 yr

15 yr

10 yr

Compare Terms

Compare Rates

Real APR

Adjustable Rates

Qualification

Affordability

Renter Affordability

Rent vs Buy

Price per Square Foot

Jumbo

Home Sellers

30 Year Fixed Mortgage Payment Calculator

30 Year Fixed Mortgage Payment CalculatorThis calculator helps home buyers estimate their monthly principal & interest payment along with the full PITI mortgage payment when buying a home using a standard, vanilla 30-year fixed rate mortgage loan. Enter the home price, down payment, APR, loan term & other homeownership expenses and we will estimate the cost of homeownership. Once you have entered all of your details you can use the button at the bottom of the calculator to create a printable amortization schedule.

Guide published by Jose Abuyuan on October 2, 2020

Homeownership is a major life goal which requires ample financial preparation and commitment. Apart from maintaining a good credit rating, you must also save enough funds for a down payment.

Once you’re ready to buy a house, there are many factors to consider. You should shop around for different lenders to secure the lowest rate. On top of this, you must choose the right loan term that fits your budget.

Among many mortgage options, the most common is the 30-year fixed-rate loan. Most lenders offer it, and many homebuyers choose it. It seems like a safe option with low monthly payments. This is especially beneficial for first-time homebuyers with limited funds. However, 30-year fixed mortgages also come with several drawbacks.

Our guide will explain how 30-year mortgages work, as well as their pros and cons. We’ll also discuss different mortgages such as conventional loans and government-backed mortgages that offer this type of loan. Knowing these options can help you choose the right mortgage deal that suits your needs.

Thirty-year fixed-rate loans come with a locked interest rate. This insures your monthly principal and interest payments remain the same for 30 years. Compared to shorter terms, 30-year fixed mortgages have lower monthly payments. However, because your payments are spread across 30 years, this puts lenders at greater risk. Thus, 30-year fixed mortgages have higher interest rates than shorter terms, such as the following loans:

If you’re a first-time homebuyer, the affordable monthly payments may convince you to take a 30-year fixed mortgage. This seems practical and can work easily into your budget. Thirty-year fixed terms are a good fit for people with limited funds who have yet to build savings. And because of the extended term, you can qualify for a larger loan amount that you otherwise cannot get with a shorter term. This can help you purchase a bigger home or a property in a better location.

Fixed-rate loans adhere to a traditional amortization schedule. This breaks down the exact monthly payments you need to make to pay your loan within the term. With a 30-year fixed mortgage, it’s spread across 360 payments throughout the life of the loan. The amortization schedule breaks down how much of each payment goes toward the principal and interest.

To obtain a sample amortization schedule for a 30-year fixed mortgage, use our calculator above.

With a traditional amortization schedule, more of your payments are applied to interest during the first several years of your loan. This reduces your principal at a slow rate. However, towards the latter half of the term, more of your payments shift to the principal. As the principal decreases, so does your interest payments. And as long as you pay on schedule, your debt should be cleared within 30 years.

Mortgage payments don’t end with the principal and interest. You must also factor in other mortgage expenses such as property taxes, homeowner’s insurance, and homeowner’s association fees. These costs may change over the years, which can increase your monthly payments. So make sure to have enough room in your budget to anticipate payment increases.

Furthermore, you might also pay additional mortgage insurance depending on your loan. For example, with a conventional loan, you might be charged private mortgage insurance (PMI). If you have a government-backed loan such as an FHA loan, you’re required to pay mortgage insurance premium (PMI). These extra costs can increase your monthly payments, so don’t forget to add them to your budget.

In the example below, let’s say you have 30-year fixed mortgage at 3 percent APR. Your home is valued at $350,000, and you make a 20 percent down payment worth $700,000. Let’s use the calculator above to estimate your total monthly mortgage payment.

| Loan details | Amount |

|---|---|

| Monthly principal & interest payment | $1,180.49 |

| Monthly taxes, insurance, & HOA | $300 |

| Total monthly mortgage payment | $1,688.82 |

When you make 20 percent down, this reduces your loan amount to $280,000. In our example, your monthly principal and interest payment will be $1,180.49. Now, if your monthly property taxes, homeowner’s insurance, and associations fees are $300, your total monthly mortgage payment will be $1,688.82.

In reality, property taxes, insurance, and homeowner’s association dues may be more expensive. This depends on the size of your home and where you live. Again, these costs can increase, so be prepared to save extra money to cover your monthly payments.

When it comes to 30-year fixed mortgages, you should look beyond cheap monthly payments. It’s important to check the total interest cost before choosing this option. Remember that loans with longer terms generate higher interest expenses.

The table below compares a 30-year fixed mortgage with a 15-year fixed term and a 20-year fixed-rate loan. It shows the difference in rates, monthly payments, and total interest costs. In this example, let’s suppose your loan amount is $280,000.

Loan amount: $280,000

| Loan Term | 30-Year FRM | 20-Year FRM | 15-Year FRM |

|---|---|---|---|

| Interest rate (APR) | 3.10% | 2.95% | 2.7% |

| Monthly principal & interest payment | $1,195.65 | $1,545.87 | $1,893.49 |

| Total interest | $150,432.53 | $91,009.83 | $60,827.45 |

The table shows that interest rates decrease with a shorter term. A 30-year fixed mortgage has the highest interest rate at 3.10 percent APR, while the lowest interest rate is a 15-year fixed mortgage at 2.7 percent APR.

When it comes to monthly payments, the longest term has the lowest monthly principal and interest payment. The 30-year fixed mortgage has a monthly payment of $1,195.65, followed by the 20-year fixed mortgage with $1,545.87. The highest monthly payment is the 15-year fixed mortgage at $1,893.49. That’s $697.84 higher than the monthly payment for the 30-year term.

However, when we compare the total interest costs, you’ll pay the greatest interest with a longer term. With a 30-year fixed loan, you’ll spend $150,432.53 on interest costs. Meanwhile, you’ll spend $91,009.83 on interest if you take a 20-year fixed term. Finally, you’ll spend the least on interest expenses if you choose a 15-year fixed mortgage, which costs $60,827.45. That’s savings worth $89,605.08 compared to a 30-year fixed mortgage.

While choosing a shorter term maximizes savings, the reality is not everyone can qualify for a shorter term. Low to moderate-income borrowers may only qualify for a 30-year fixed term. This may be due to a low credit score and insufficient funds. If you have a 30-year fixed mortgage, you can reduce interest costs and shorten your term by making extra payments.

Low monthly payments are the main advantage of a 30-year fixed mortgage. If you currently have a tight budget, this can work well for you. It’s also why so many homebuyers choose it over shorter terms.

Furthermore, the long term allows you to qualify for a larger loan amount compared to a shorter term. With a bigger loan, you can buy a bigger house or select a better residential area for your family. And since your interest rate is fixed, it guarantees that your monthly principal and interest payments won’t increase throughout the entire term.

However, it comes with several disadvantages. In exchange for low monthly payments, you’ll spend greater interest costs. That’s years of interest payments that you could have saved. It could be money for more important expenses, such as your child’s college education.

Thirty-year fixed mortgages also have higher rates than shorter terms. It’s typically 0.25 percent to 1 percent higher than 15-year fixed mortgages. Moreover, if you do buy a larger house, this requires higher maintenance expenses and property insurance. Lastly, 30-year fixed terms build home equity much slower. It’s a long time, which means you could be paying it until retirement.

We created the table below to summarize the pros and cons of 30-year fixed-rate loans:

| Pros | Cons |

|---|---|

| Affordable monthly payments | Higher interest rates than shorter terms |

| It’s easier to qualify for a 30-year fixed mortgage than a shorter term | Pay higher interest costs with a 30-year fixed mortgage compared to a shorter term |

| The extended term allows you to qualify for a larger loan amount to purchase a bigger home | A larger home usually means higher maintenance costs and property insurance |

| Your monthly principal and interest payments stay the same for the entire loan | It will take longer to pay off your mortgage, also builds equity slower |

Before applying for a mortgage, make sure to improve your credit score. This will help you secure a lower rate, which translates to interest savings. You can also check your credit report for any misinformation, such as a wrong billing address or undocumented payments. Disputing errors on your credit report can help increase your credit score. You are entitled to one free copy of your credit report every 12 months. You can request a free copy at annualcreditreport.com.

You can obtain 30-year fixed mortgages from the following conventional loans and government-backed mortgages:

Conventional mortgages are loans that are not directly funded by the government. These are often bundled into mortgage-backed securities that are secured by Fannie Mae and Freddie Mac. Borrowers can obtain conventional mortgages from private lenders such as banks, credit unions, and mortgage companies.

To qualify for a conventional loan, borrowers must have a credit score of at least 680. To secure more favorable rates, aim for a credit score of 700 and above. Making a higher down payment also helps reduce your interest rate.

Another important qualifying factor is debt-to-income ratio (DTI). DTI ratio is a percentage that measures your total monthly debt payments with your gross monthly income. A lower DTI ratio indicates lower risk for lenders, thus increasing your chances for approval. If you have a high DTI ratio, paying off high-interest debts can help reduce it.

There are two main types of DTI ratios:

Conventional loans are classified into two types:

Borrowers looking for an affordable mortgage option with relaxed credit standards can turn to government-backed loans. These are specifically made for borrowers with limited funds who need home ownership assistance. Government-sponsored mortgages come with lower interest rates compared to conventional loans. And depending on the type of government-backed loan, you can take advantage of low down payments or 100 percent financing (no down payment required).

Moreover, it’s generally easier to qualify for a government-backed mortgage than a conventional loan. For example, you can obtain an FHA loan with a credit score of 500, provided you make 10 percent down. Government-backed loans also do not impose prepayment penalty unlike most conventional mortgages.

Consumers can choose from the following government-backed home loans:

FHA loans are mortgages secured by the Federal Housing Administration. They provide programs to help low to moderate-income families purchase homes. FHA loans are a good fit for first-time homebuyers in need of low-cost mortgage options with lenient qualifying standards. You can get FHA loans from lenders such as banks, credit unions, and mortgage companies. They often come in 30-year fixed-rate terms, but they also come in 15-year and 20-year fixed-rate loans.

Under the FHA loan program, you can qualify with a minimum credit score of 500. But as a trade-off, you must make a down payment of at least 10 percent. Borrowers with a credit score of 580 and above can make a down payment as low as 3.5 percent. As for the required DTI ratio, your front-end DTI must not be more than 31 percent. For back-end DTI ratio, it should not exceed 43 percent. However, some borrowers may qualify with a 50 percent DTI if they have compensating factors such as student debt.

For borrowers with low credits scores, FHA mortgages start off with low rates. But it gets costly over the years because of mortgage insurance premium (MIP), which is paid for the entire loan. MIP is paid both as an upfront cost and an annual insurance fee that’s rolled into your monthly payments. The annual cost of MIP can be anywhere between 0.45 percent to 1.05 percent of your loan amount. Over time, the rate increases the further you build home equity.

USDA loans are mortgages backed by the U.S. Department of Agriculture. These are geared towards families with limited incomes, helping them buy homes in rural areas. USDA loans come with low interest rates and require no down payment (100 percent financing). Borrowers are eligible for a USDA loan if their credit score is at least 640. As for the required DTI ratio, your front-end DTI must not exceed 29 percent. Meanwhile, your back-end DTI ratio must not be more than 41 percent.

Like FHA loans, USDA loans also charge mortgage insurance premium called the guarantee fee. This is required to offset the the zero down payment option. It is paid both as an upfront cost and an annual guarantee fee that’s rolled into your monthly payments. The upfront guarantee fee is 1 percent of your loan amount, while the annual guarantee free is 0.35 percent of your principal loan balance.

Only primary homes in USDA rural areas are qualified for USDA financing. The program only approves areas that are not part of large cities or metropolitan centers. They usually choose places with populations of less than 20,000 people. However, in some cases, they may approve loans in areas with 35,000 people.

The geographic requirement may be limiting to homebuyers. But in reality, around 97 percent of land mass in the U.S. is eligible for USDA rural development. If you plan on living outside the city, consider taking a USDA loan, especially if you’re short on funds.

VA loans are mortgages guaranteed by the U.S. Department of Veterans Affairs. These are special loans awarded to military veterans, active-duty service members, and qualifying military spouses. As an incentive for their service, borrowers are entitled to flexible qualifying standards and low interest rates.

The VA program also offers 100 percent financing (zero down payment) for eligible borrowers. And unlike FHA or USDA loans, VA mortgages do not require MIP. However, to decrease the cost of the loan on U.S. taxpayers, borrowers are charged a VA funding fee.

To obtain a VA loan, your credit score must at least be 620. Though you may qualify with a lower credit score, it’s easier to get approval if your credit rating is higher. VA loans primarily base their DTI requirement on back-end DTI, which should not exceed 41 percent.

Applicants must ideally have at least 2 years of full-time work experience. If you are self-employed or a part-time worker, VA lenders will usually ask for additional documents to further review your financial background. But generally, it’s easier to qualify for a VA loan than a conventional mortgage. This is a great option for active military member and veterans who have yet to improve their credit scores and build their savings.

Thirty-year fixed-rate loans remain the most widely chosen home financing tool in America. This option is appealing to many homebuyers precisely because of affordable monthly payments. The longer term also allows borrowers to secure a larger loan compared to 15-year fixed loans. With a larger loan, borrowers can buy a bigger house or relocate to a safer neighborhood. And even with high interest costs, many borrowers still choose 30-year fixed mortgages for the benefit of low monthly payments.

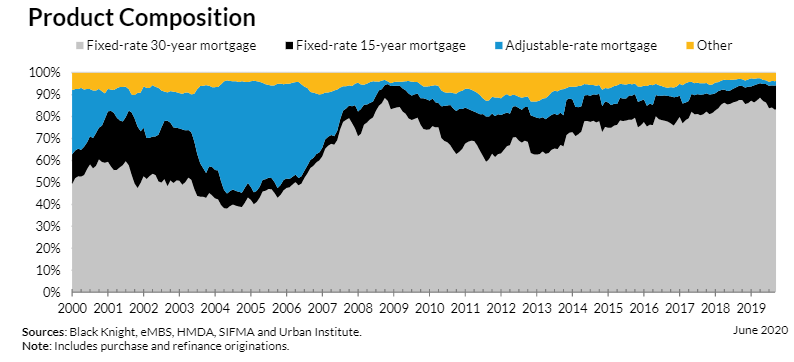

In June 2020, 30-year fixed mortgages accounted for 74.4 percent of new mortgage originations in the market. This was according to the Urban Institute’s Housing Finance at a Glance: A Monthly Chartbook, August 2020. The graph below shows the market share for different mortgage products from the year 2000 to June 2020.

Graph from the Urban Institute

Following 30-year fixed mortgages are 15-year fixed-rate loans, which accounted for 16.4 percent of new loan originations in June 2020. Many of these loans were also reported refinances. Because of the low interest rates, many consumers were driven to refinance their mortgage. The Urban Institute reports refinances for Fannie Mae and Freddie Mac reached in the 71 to 75 percent range. Meanwhile, refinances for Ginnie Mae grew to 49.2 percent.

Next are adjustable-rate mortgages (ARM), which made up 1.8 percent of new mortgage originations in June 2020. ARMs are especially beneficial while interest rates remain low. But after the introductory period, if rates increase, you must be ready for higher monthly payments. To lock in a low rate, many people with ARMs eventually refinance to a fixed-rate loan.

Last but not least, 7.4 percent accounted for “Other” types of mortgage products. This includes less popular financing options such as 10-year, 20-year, and 25-year fixed-rate loans. Though these mortgage products are not common among homebuyers, they provide features that address particular consumer needs.

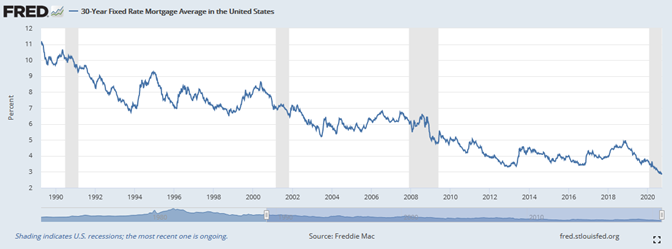

Average rates for 30-year fixed-rate loans have been gradually decreasing since the 1990s. The graph below illustrates the trend for average 30-year fixed mortgage rates from 1990 to 2020. If we look at the average rates between January 1990 to 1995, they generally played within the 7 percent to 9 percent range. Between 1996 to 1999, average rates decreased and played within the 6 percent to 7 percent range.

The decreasing rates were attributed to declining inflation seen in the late 90s. In research published by the Economic Policy Institute, economic growth and weakened inflation was due in part to the mainstream use of the internet. The increased investment in research and development paved the way for further economic growth.

Data from the Federal Reserve Bank

| Date | Average 30-Year FMR |

|---|---|

| January 5, 1990 | 9.83% |

| January 4, 1991 | 9.56% |

| January 3, 1992 | 8.24% |

| January 15, 1993 | 8.04% |

| January 14, 1994 | 6.99% |

| January 13, 1995 | 9.19% |

| January 12, 1996 | 7.08% |

| January 10, 1997 | 7.85% |

| January 9, 1998 | 6.94% |

| January 8, 1999 | 6.79% |

| January 7, 2000 | 8.15% |

| January 5, 2001 | 7.07% |

| January 4, 2002 | 7.14% |

| January 3, 2003 | 5.85% |

| January 8, 2004 | 5.87% |

| January 6, 2005 | 5.77% |

| January 5, 2006 | 6.21% |

| January 4, 2007 | 6.18% |

| January 3, 2008 | 6.07% |

| January 8, 2009 | 5.01% |

| January 7, 2010 | 5.09% |

| January 6, 2011 | 4.77% |

| January 5, 2012 | 3.91% |

| January 3, 2013 | 3.34% |

| January 2, 2014 | 4.53% |

| January 8, 2015 | 3.73% |

| January 7, 2016 | 3.97% |

| January 5, 2017 | 4.20% |

| January 4, 2018 | 3.95% |

| January 3, 2019 | 4.51% |

| January 2, 2020 | 3.72% |

| September 24, 2020 | 2.90% |

By the early 2000s, average rates continued to decrease, going down to 5.85 percent by January 2003. Average rates between January 2004 to January 2010 generally remained within the 5 percent to 6 percent range.

Between 2007 to 2010, the Subprime Mortgage Crisis affected consumers and lending institutions. According to the Federal Reserve History, it was caused by earlier expansion of mortgage credit to subprime borrowers. This left many homeowners underwater, owing more on their homes than their property is worth. As a result, companies such as Fannie Mae and Freddie Mac suffered great losses and were seized by the federal government in 2008. The mortgage crisis was known to aggravate the Great Recession of December 2007 to 2009.

Towards 2010 to 2015, average rates continued to decrease; from 5.90 percent in January 2010 to 3.97 percent in January 2015. By 2019, average rates dropped significantly toward the end of the year. This prompted more borrowers to refinance their mortgages. Rates continued to decline toward 2020, reaching as low as 3.72 percent in January 2, 2020.

In Q1 of 2020, COVID-19 affected the U.S. economy. Due to this crisis, many companies were forced to close because of social distancing measures and stay-at-home orders. According to the Bureau of Labor Statistics, unemployment rose to 14.7 percent in April 2020, which was the highest since the Great Depression. To aid citizens, the government created aid programs to provide financial assistance and loan payment extensions to affected homeowners. As of September 24, 2020, the average mortgage rate for 30-year fixed loans dropped to 2.90 percent.

Thirty-year fixed-rate mortgages are the most popular loan purchasing tool for homebuyers. It’s accessible to most consumers because of the affordable monthly payments. These are easier to qualify for compared to short-term loans such as 15-year fixed mortgages. Moreover, there are government-backed loans which offer zero down options and relaxed qualifying requirements.

On the other hand, 30-year fixed mortgages generate expensive interest costs compared to shorter terms. That’s interest you can save and spend for other important life purchases. The longer term also keeps you from gaining home equity faster. This means you might be paying your mortgage debt until you retire.

If you have a 30-year fixed mortgage, you can reduce your term and slash interest costs by making extra payments. Another way is to eventually refinance your loan once you can afford it. Refinancing can lower your rate and shorten your term to help you maximize your interest savings.

Are you shopping for home loans to compare rates? Use our mortgage rate comparison calculator.

Jose Abuyuan is a web content writer, fictionist, and digital artist hailing from Las Piñas City. He is a graduate of Communication and Media Studies at San Beda College Alabang, who took his internship in the weekly news magazine the Philippines Graphic. He has authored works professionally for over a decade.