Fixed Rates

30 yr

25 yr

20 yr

15 yr

10 yr

Compare Terms

Compare Rates

Real APR

Adjustable Rates

Qualification

Affordability

Renter Affordability

Rent vs Buy

Price per Square Foot

Jumbo

Home Sellers

10 Year Fixed Mortgage Payment Calculator

10 Year Fixed Mortgage Payment CalculatorThis calculator helps home buyers estimate their monthly principal & interest payment along with the full PITI mortgage payment when buying a home using a 10-year fixed rate mortgage loan. The 15-year is a popular choice among homeowners who want to refinance their homes into a lower rate while paying their loan off quickly. Enter the home price, down payment, APR, loan term & other homeownership expenses and we will estimate the cost of homeownership. Once you have entered all of your details you can use the button at the bottom of the calculator to create a printable amortization schedule.

Guide published by Jose Abuyuan on September 24, 2020

Planning on buying a home involves considering many factors. Aside from having a good credit score and saving for a down payment, you need to secure favorable rates and terms.

When it comes to loan terms, most homebuyers prefer to take 30-year fixed-rate loans. The longer term generally offers low monthly payments, though with higher interest rates compared to 15-year fixed loans. On the other hand, did you know you can also choose 10-year fixed-rate mortgages?

Our guide will discuss how 10-year fixed-rate mortgages work and what they are commonly used for. We’ll also talk about its benefits and drawbacks, as well as when to choose a 10-year fixed-rate loan.

When you take a 10-year fixed-rate loan, the rate is locked for the entire payment term. It ensures your monthly principal and interest payments remain the same for 10 years. Though your taxes and insurance payments can change, your total monthly mortgage payments won’t increase dramatically throughout the loan term. Ten-year fixed mortgages generally have lower rates compared to longer terms, such as 30 or 15-year loans. Higher rates are assigned to longer terms because they carry greater risk for lenders.

Though it’s used as a loan purchase tool, 10-year fixed-rate loans are more popular for consumers who want to refinance their mortgage. Refinancing is essentially replacing your original loan with a new one. If you choose this option, you can secure more favorable rates. This means you can also select much shorter repayment terms. Overall, when done right, refinancing can help you save in the long-run.

Apart from 10-year fixed-rate loans, 15-year fixed rate loans are a more popular refinancing option. It comes with slightly lower monthly payments than a 10-year term. Though it’s not as short as a 10-year loan, shifting to a 15-year fixed mortgage significantly reduces overall interest costs.

Furthermore, 10-year fixed mortgages adhere to a traditional amortization schedule. This breaks down the number of payments you need to make to pay off your loan within the agreed term. It details how much of your payment goes toward your interest and principal each month.

How are your mortgage payments distributed? During the first few years of the loan, more of your payments are applied to interest rather than the principal. This reduces the principal amount you borrowed much slower. But during the latter years of the loan, which is after 5 years, more of your payments are applied to the principal while interest payments decrease. As long as you pay on schedule, by the end of the 10-year term, your mortgage will be completely paid off.

To obtain a sample amortization schedule for a 10-year fixed mortgage, you can use our calculator on top.

Apart from your monthly principal and interest payments, you must factor in other mortgage expenses. This will help you estimate the actual cost of your monthly mortgage. Find out the costs of regular taxes and insurance. For conventional mortgages, you might need to pay private mortgage insurance. And for government-backed mortgages such as FHA loans, you must pay mortgage insurance premium.

If you calculate your principal and interest, together with regular taxes and insurance charges, you will find out your total monthly mortgage payment. The amount may change slightly over the years depending on the kind of loan you get.

Ten-year fixed-rate loans are commonly taken as conventional mortgages. Conventional loans are not directly backed by government funding and are offered by banks, mortgage companies, and credit unions. For decades, it’s the most commonly used type of home financing in the country. As of Q1 in 2020, the U.S. Census Bureau reported that conventional loans comprised around 68.3 percent of new mortgages in America.

Conventional mortgages are a good fit for consumers with high credit scores, large savings, and reliable sources of income. In this respect, more financially stable borrowers can afford conventional 10-year fixed-rate mortgages.

On the other hand, there are instances when people refinance their government-backed mortgage into a conventional loan. This is common among borrowers with FHA loans who want to eliminate mortgage insurance premium (MIP). Unlike PMI, mortgage insurance for FHA loans are usually required for the entire term. The annual MIP cost is usually between 0.45 percent to 1.05 percent of the loan amount—a burdensome extra cost. One way to remove MIP is to refinance into a conventional mortgage.

People prefer 10-year fixed-rate loans to gain home ownership more quickly. They also take advantage of it to reduce interest costs compared to a 30-year fixed loan. That’s why homeowners commonly use it as a refinancing tool to shorten their repayment term. Refinancing to a 10-year fixed-rate loan with a lower rate slashes thousands of dollars on interest charges. But take note: Expect to have higher monthly payments when you shorten your loan term.

A 10-year loan is advantageous if you want to pay your mortgage before retirement. If you have enough funds to pay your loan sooner, why not? With one major debt off your list, you can build greater savings toward your retirement funds. In other cases, you may want to use your money to fund your child’s college education. If you’re short on funds, you can borrow against your home equity to pay for their college tuition. Likewise, you can use a home equity loan to renovate and expand your property in the future, which further increases its value.

In contrast, 10-year fixed mortgages are not common precisely because of the expensive monthly payments. Though 30-year fixed loans generate higher lifetime interest costs, they usually have lower monthly payments. Many homebuyers can fit this into their budget, which is more manageable especially with tight funds. For the sake of home ownership, buyers are willing to trade-off lower monthly payments for higher lifetime interest charges. But once they can afford larger monthly payments, they can refinance to a shorter term and lower rate to maximize their savings.

Thus, consider a 10-year fixed mortgage if you have ample funds to make larger monthly payments. It’s also beneficial to refinance to a 10-year term if rates drop low enough to justify the expensive closing costs.

Again, there are two main benefits to choosing a 10-year fixed mortgage. First, it helps you build home equity faster. And second, it saves you years’ worth of interest charges. To understand how this works, let’s compare a 30-year fixed-rate loan with a 10-year-fixed-rate mortgage. Using the calculator above, let’s estimate the results.

Suppose your home’s price is $375,000 and you made a 20 percent down payment of $75,000 to avoid PMI. The following table indicates monthly principal and interest payments and total interest costs if you take a 30-year fixed loan or a 10-year fixed loan.

Loan amount: $300,000

| Loan | 30-Year Fixed Mortgage | 10-Year Fixed Mortgage | Difference |

|---|---|---|---|

| Interest rate (APR) | 3.05% | 2.5% | 0.55% |

| Monthly principal & interest payment | $1,272.92 | $2,828.10 | $1,555.18 |

| Total interest costs | $158,249.88 | $39,371.65 | $118,878.23 |

Based on the table, the monthly principal and interest payments are higher with a 10-year mortgage. You’ll spend $2,828.10 per month on a 10-year loan, while you’ll pay $1,272.92 per month with a 30-year loan. The 10-year loan is $1,555.18 more expensive than a 30-year mortgage.

However, the savings are more apparent when you look at the total interest costs. With a 30-year mortgage, you’ll spend $158,249.88 on overall interest charges. Meanwhile, you only spend $39,371.65 on total interest charges with a 10-year mortgage. Thus, you’ll save $118,878.23 on lifetime interest costs if you choose a 10-year term.

While shorter terms yield greater savings, not everyone can afford expensive monthly payments. Buyers who cannot shoulder high monthly payments end up choosing 30-year fixed-rate loans. It also allows them to borrow a larger loan amount to afford the home they need. For this reason, 10-year terms are not a popular home financing option for most buyers.

Ten-year fixed-rate mortgages are appropriate for people with large incomes and high credit scores. You should take this option if you have ample funds to afford large monthly mortgage payments.

It has many advantages, such as paying your mortgage sooner and lower interest rates than a longer term. The locked interest rate also ensures your total monthly payments remain within an affordable range. In case you can’t make a 20 percent down, PMI cost is lower with a shorter term compared to a 30-year term. Choosing a 10-year mortgage builds home equity faster and saves thousands of dollars on interest charges.

On the other hand, beware of the drawbacks. If you have a low credit score, you cannot qualify for a shorter term. Some people with 30-year fixed mortgages take this option because it’s the only term they could qualify for. It’s not practical for buyers who cannot afford the expensive monthly payments.

The large monthly payments also limit your purchasing power. You can’t save as much or invest your money in other lucrative ventures. And in case you face an emergency, you’ll have less cash to cover expenses unless you have enough emergency funds. Finally, once you pay down your mortgage, your money is tied to your house. To cash it out, you’ll have to take out a home equity loan, with is another form of debt.

To summarize the pros and cons of choosing a 10-year fixed mortgage, we made the table below:

| Pros | Cons |

|---|---|

| 10-year terms have lower interest rates than longer terms | People with poor credit scores and limited funds cannot qualify |

| If you make less than 20% down payment, it comes with lower MIP compared to a 30-year fixed term | More expensive monthly payments compared to a 30-year fixed mortgage |

| Your rate is fixed, no need to worry about increasing monthly principal and interest payments | Limits your cash for savings and other important purchases |

| Pays your mortgage a lot faster | Riskier in case you lose your job or face a sudden medical emergency |

| Shorter terms save more money on interest costs | Prevents you from investing in other worthwhile business ventures |

| Builds home equity sooner, own your home faster | Equity is bound to your house – to liquidate it, you must take a home equity loan |

By now you know 10-year fixed mortgages are not the most popular type of home loan. That said, 30-year fixed-rate mortgages remain the most purchased home financing tool in the market.

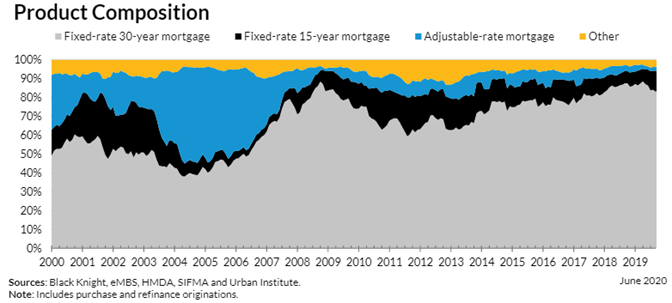

In a survey conducted by the Urban Institute in June 2020, 74.4 percent of new originations accounted for 30-year fixed rate mortgages. This is according to Housing Finance at a Glance: A Monthly Chartbook, August 2020. However, this actually declined from 81.1 percent in March 2020. This decrease is attributed to the economic crisis caused by COVID-19.

Below is a graph from the Urban Institute which illustrates the market share for mortgage originations from the year 2000 to June 2020:

Following 30-year fixed mortgages are 15-year fixed-rate loans, accounting for 16.4 percent in new originations. The report states these were primarily refinance products, as refinancing continues to thrive due to low interest rates. With interest rates at historic lows, the refinancing rate for Freddie Mac and Fannie Mae reached the 71 – 75 percent range, while Ginnie Mae refinances increased to 49.2 percent.

Next, adjustable-rate mortgages (ARM) accounted for 1.8 percent of the market share. The smaller share indicates that certain consumers risk taking loans with unpredictable payments. But eventually, people with ARMs refinance to fixed-rate conventional loans to lock in lower rates. Meanwhile, around 7.4 percent of the market share is comprised of other mortgage products. This includes less popular loan options, such as 10-year fixed-rate loans and 20-year fixed-rate mortgages.

Homebuyers who can afford to pay their loans sooner should consider a 10-year fixed-rate loan. This is ideal for borrowers with high credit scores and stable incomes. People also use 10-year fixed mortgages to refinance to a shorter term and reduce their current mortgage rate. Shorter mortgage terms also have lower rates compared to 30-year loans. It helps you slash years of interest charges on your mortgage.

On the other hand, 10-year fixed mortgages come with higher monthly payments. It’s not a practical option for homebuyers with limited budgets and less-than-perfect credit scores. Because of this, consumers are usually drawn to 30-year fixed mortgages for lower monthly payments. But after some time, if they can afford it, they can refinance to a shorter term with a lower rate. Consumers can refinance to a 10-year fixed mortgage for greater interest savings.

Need to learn more about mortgage amortization? Check out our guide on our home loan amortization calculator.

Jose Abuyuan is a web content writer, fictionist, and digital artist hailing from Las Piñas City. He is a graduate of Communication and Media Studies at San Beda College Alabang, who took his internship in the weekly news magazine the Philippines Graphic. He has authored works professionally for over a decade.