Fixed Rates

30 yr

25 yr

20 yr

15 yr

10 yr

Compare Terms

Compare Rates

Real APR

Adjustable Rates

Qualification

Affordability

Renter Affordability

Rent vs Buy

Price per Square Foot

Jumbo

Home Sellers

20 Year Fixed Mortgage Payment Calculator

20 Year Fixed Mortgage Payment CalculatorThis calculator helps home buyers estimate their monthly principal & interest payment along with the full PITI mortgage payment when buying a home using a 20-year fixed rate mortgage loan. Enter the home price, down payment, APR, loan term & other homeownership expenses and we will estimate the cost of homeownership. Once you have entered all of your details you can use the button at the bottom of the calculator to create a printable amortization schedule.

Guide published by Jose Abuyuan on September 29, 2020

When it comes to purchasing a house, 30-year fixed mortgages are often chosen by consumers. This is specifically beneficial for first-time homebuyers who want low monthly payments. On the downside, it’s a long time to be paying your mortgage. It also means higher interest costs in the long-run.

To maximize savings, other consumers choose shorter loans, such as 15-year fixed mortgages. However, not everyone can afford its expensive monthly payments. It can also be harder to qualify for a 15-year fixed-rate loan. But, did you know it’s possible to get a 20-year fixed mortgage instead?

Our guide will discuss how 20-year fixed-rate loans work and when it’s advantageous to take this option. We’ll talk about its benefits and drawbacks to help you decide if this loan term is right for you. The article will also show how much you can save with a 20-year fixed mortgage compared to a 30-year fixed-rate loan.

Twenty-year fixed-rate mortgages come with a locked interest rate that’s paid within 20 years. The fixed rate guarantees your interest and principal payment stays the same throughout the entire loan. And compared to 30-year fixed terms, interest rates for 20-year fixed mortgages are slightly lower. It’s typically lower by around 0.15 percent to 0.375 percent than a 30-year fixed loan.

On the other hand, when it comes to the monthly payments, 20-year fixed mortgages have higher monthly payments than 30-year fixed loans. However, this is not as expensive as monthly payments for 15-year fixed mortgages. When you choose a 20-year fixed loan, you’re slashing 10 years’ worth of interest charges. It’s also used as a refinancing tool by consumers who want to shorten their loan term.

Refinancing is the process of taking a new loan to replace your existing mortgage. This option allows you to reduce your current rate and shorten your loan term. It’s beneficial when done during the early years of a loan, and when market rates significantly drop. When done right, it can offer substantial interest savings.

Just like other fixed-rate loans, 20-year fixed-rate mortgages adhere to a traditional amortization schedule. This determines the precise monthly payments you need to make for the loan to amortize fully across 240 payments. It also breaks down how much of each payment go to toward principal and interest.

How are mortgage payments distributed? With a traditional amortization schedule, during the first years of your loan, more of your payments are applied to interest. Since more money pays for interest, this reduces your principal slowly. But towards the latter years of your loan term, more of your payments are applied to the principal. As the principal decreases, less payments go to interest costs. Your mortgage should be paid within 20 years as long as you make payments on time.

To get a sample amortization schedule for a 20-year fixed mortgage, use our calculator on top.

Apart from the principal and interest, your monthly mortgage payments also include other housing costs. Don’t forget to factor in property taxes, homeowner’s insurance, and homeowner’s association fees. Unlike principal and interest payments, these housing expenses can change over the years. Before they increase, make sure to have enough room in your budget to cover monthly payments.

Moreover, depending on the type of housing loan you get, you might be required to pay additional mortgage insurance. For a conventional loan, you might need to pay private mortgage insurance (PMI). And if you have a government-backed loan such as an FHA mortgage, you’re required to pay mortgage insurance premium (MIP). These extra expenses significantly add to your monthly payments, so be sure to include them when you plan your budget.

For instance, let’s say you took a 20-year fixed mortgage at 3 percent APR, with the home priced at $300,000. You make a 20 percent down worth $60,000. Using the calculator on top, let’s estimate your total monthly mortgage payment.

| Loan details | Amount |

|---|---|

| Monthly principal & interest payment | $1,331.03 |

| Monthly taxes, insurance, & HOA | $300 |

| Total monthly mortgage payment | $1,631.03 |

With 20 percent down, your loan amount is reduced to $240,000. In this example, your monthly principal and interest payment will be $1,331.03. If your monthly property tax, insurance, and homeowners’ association fees are $300, your total monthly mortgage payment will be $1,631.03.

Again, your taxes and insurance expenses may likely increase in the future. If you have a tight budget, save extra to anticipate any sudden increase in your monthly payments.

Consumers can find 20-year fixed-rate loans in the following conventional loans and government-backed mortgages:

Conventional loans are mortgages that do not receive direct funding from the government. These loans are usually packaged into mortgage-backed securities that are guaranteed by Fannie Mae and Freddie Mac. You can obtain conventional mortgages from private banks, mortgage companies, and credit unions. Conventional loans are also available in different loan terms:

To qualify for a conventional loan, aim for a credit score of 680 and above. You have better chances of securing a lower rate if your credit rating is 700 and up. For this reason, conventional loans are often taken by borrowers with good credit scores and consistent sources of incomes.

Conventional loans are divided into two main types:

Government-backed housing loans are a good fit for low to moderate-income homebuyers. These loans are directly funded by the government and have much lower rates than conventional mortgages. They also come with relaxed qualifying standards, allowing poor credit score borrowers to obtain loans. If you’re a first-time homebuyer looking for an affordable option, consider a government-backed mortgage.

Consumers can choose from the following government-funded housing loans:

You can secure an FHA loan if your credit score is 500, provided that you make a 10 percent down payment. Meanwhile, borrowers with a credit score of 580 and above can make a down payment as low as 3.5 percent. As for VA and USDA loans, qualified borrowers are entitled to a zero down payment option. Closing costs for government-backed mortgages are usually more affordable than conventional loans.

If you’re looking for a loan with a shorter term, consider 20-year fixed-rate loans. It’s ten years shorter than a 30-year fixed mortgage. This option also comes with monthly payments that are not as expensive as 15-year fixed-rate terms. When you want a shorter term but can’t afford a 15-year fixed mortgage, your next best option is a 20-year fixed term. On the other hand, 20-year fixed mortgage rates are not as low as 15-year fixed-rate loans, which can be up to 1 percent lower.

Just how much can you save? The table below compares a 20-year fixed-rate loan with a 15-year fixed mortgage and a 30-year fixed-rate loan. For example, let’s suppose your home is priced at $350,000 and you made 20 percent down worth $70,000. Let’s use the calculator above to estimate the results.

Loan amount: $280,000

| Loan Term | 15-Year FRM | 20-Year FRM | 30-Year FRM |

|---|---|---|---|

| Interest rate (APR) | 2.70% | 2.95% | 3.10% |

| Monthly principal & interest payment | $1,893.49 | $1,545.87 | $1,195.65 |

| Total interest charges | $60,827.45 | $91,009.83 | $150,432.53 |

The table shows that the interest rate increases as the loan term is extended. The lowest rate is the 15-year fixed mortgage at 2.7 percent APR, while the 30-year fixed mortgage has the highest rate at 3.10 percent APR. Right in the middle is the 20-year fixed mortgage at 2.95 percent APR.

When it comes to monthly principal and interest payments, the 15-year fixed mortgage has the highest payment at $1,893.49. This is more expensive by $697.84 than the 30-year term, which is $1,195.65. Meanwhile, your monthly payment is $1,545.87 with a 20-year fixed term, making it $350.22 higher than a 30-year fixed-rate loan. In this respect, 20-year fixed mortgage payments are more affordable than 15-year fixed terms.

Finally, you’ll see the most savings when you compare the total interest costs. With a 30-year fixed mortgage, you’ll pay $150,432.53 in overall interest. However, you’ll only spend $60,827.45 on total interest if you choose a 15-year fixed loan, which saves $89,605.08. Meanwhile, you spend $91,009.83 on total interest with a 20-year fixed term. This saves you $59,422.70 on interest charges. Though you don’t save as much on interest with a 20-year fixed mortgage compared to a 15-year term, it’s still better than taking a 30-year fixed-rate loan.

Consider taking a 20-year fixed-rate loan if you cannot afford a 15-year mortgage. It saves tens of thousands of dollars on interest charges compared to a 30-year loan. You also get to pay your mortgage 10 years earlier.

Choosing a 20-year fixed mortgage allows you to pay your loan earlier than a 30-year term. Consider this if your goal is to pay your mortgage before retiring. Once this major debt is paid off, you can focus more on saving for your retirement funds. Likewise, you may even devote that money for other important life expenses like sending your child to college.

Twenty-year fixed-rate loans also come with slightly lower rates than a 30-year fixed mortgage. And with 10 years less on your loan, you won’t spend as much on lifetime interest charges. Moreover, monthly payments are more affordable with a 20-year fixed mortgage than a 15-year fixed-rate loan. This also means you can qualify for a larger loan amount compared to a 15-year fixed term. Some borrowers also consider refinancing to a 20-year fixed mortgage after 2 or 3 years once they are eligible for refinancing.

On the other hand, 20-year fixed mortgages come with several drawbacks. Borrowers can’t take this option if they cannot afford the higher monthly payment. Making higher payments also limits your purchasing power. Focusing on mortgage payments also keeps you from saving extra income today, and from investing in other profitable ventures.

Compared to a 15-year mortgage, 20-year fixed mortgages have a slightly higher rate. You also save more on interest costs with a 15-year fixed mortgage compared to a 20-year fixed term. However, it’s still worth taking a 20-year fixed mortgage than a 30-year fixed loan which results in higher interest costs.

We summarized the pros and cons of choosing a 20-year fixed-rate loan below:

| Pros | Cons |

|---|---|

| More affordable monthly payment compared to a 15-year fixed mortgage | More expensive monthly payment compared to a 30-year fixed mortgage |

| Slightly lower interest rate than a 30-year fixed-rate loan | Slightly higher interest rate compared to a 15-year fixed rate loan |

| Pay your loan 10 years earlier compared to a 30-year term | Not as short as a 15-year fixed mortgage which cuts your loan term in half |

| Saves more on total interest charges compared to a 30-year fixed mortgage | Saves less on total interest charges compared to a 15-year fixed mortgage |

| Allows you to qualify for a larger loan compared to a 15-year fixed-rate mortgage | Depending on your budget, you might not be able to afford higher monthly payments |

| Once your mortgage is paid, you free up your cash flow to save more money for your retirement funds | Limits your purchasing power, you also cannot invest on other business ventures |

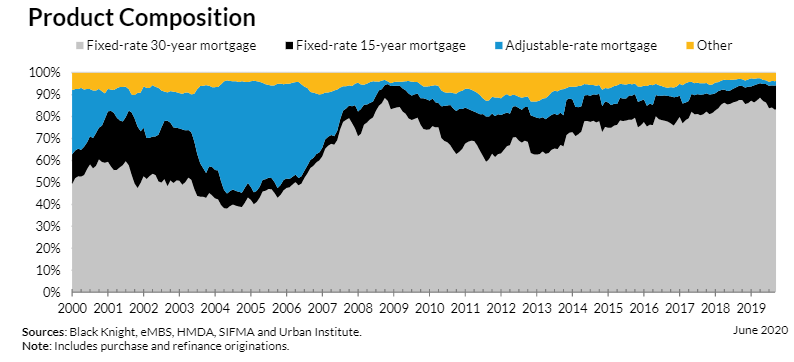

The most widely chosen loan purchase tool in the U.S. are 30-year fixed-rate loans. This is an attractive option for most homebuyers because of low monthly payments. The Urban Institute reported that 30-year fixed mortgages accounted for 74.4 percent of new mortgage originations in the U.S. in June 2020. This was reported on Housing Finance at a Glance: A Monthly Chartbook, August 2020.

The following graph illustrates the market share of different mortgage products from the year 2000 to June 2020.

Graph from the Urban Institute

In second place are 15-year fixed-rate mortgages, which accounted for 16.4 percent of new mortgage originations in June 2020. Majority of these 15-year fixed loans were refinances, as many homeowners want to refinance their mortgage due to low interest rates. Refinancing grew to the 71 to 75 percent range for Fannie Mae and Freddie Mac, while Ginnie Mae’s refinancing grew to 49.2 percent.

Next are adjustable-rate mortgages (ARM) on third place, which accounted for 1.8 percent of the market share. ARMs are characterized by a changing interest rate. For example, if you take a 5/1 ARM, your rate remains the same for an introductory period of 5 years. After this period, depending on market conditions, your rate may increase or decrease. This means your monthly mortgage payments may grow higher in succeeding years. For this reason, many consumers with ARMs eventually refinance into a fixed-rate loan.

Finally, an estimated 7.4 percent of the market share accounted for “Other” mortgage products. This includes less popular home financing options like 10-year fixed-rate mortgages and 20-year fixed-rate loans. Though 20-year fixed mortgages are not commonly taken by consumers, it’s a more affordable alternative to 15-year fixed-rate loans. It also saves 10 years of interest charges compared to a 30-year fixed mortgage.

If you’re looking for a shorter mortgage term with more affordable monthly payments, choose a 20-year fixed mortgage. Your payments will be higher, but they won’t be as expensive as 10-year or 15-year fixed terms. You’ll remove 10 years of interest charges compared to taking a 30-year fixed mortgage. If you can afford to make slightly higher monthly payments, consider this option.

Twenty-year fixed-rate loans are also a refinancing tool used by homebuyers. If you can refinance to a low enough rate, this can help reduce your total interest charges. It’s also most beneficial if you refinance early into to the loan term, preferably within 2 to 3 years. Before refinancing, make sure to improve your credit score to be eligible for more favorable interest rates.

Need to compare costs between different loan terms? Use our mortgage term comparison calculator.

Jose Abuyuan is a web content writer, fictionist, and digital artist hailing from Las Piñas City. He is a graduate of Communication and Media Studies at San Beda College Alabang, who took his internship in the weekly news magazine the Philippines Graphic. He has authored works professionally for over a decade.