Amortization

Biweekly Payments

Interest Only Payments

Loan Amortization Calculator

Loan Amortization CalculatorUse this calculator to figure out the payment amount & total interest due for various loan scenarios. Once you have found a suitable loan you can generate a printable amortization schedule.

Guide published by Jose Abuyuan on February 20, 2020

When it comes to your money, it's important to learn how to manage your finances to save and make worthwhile investments. Unfortunately, many people lack basic skills and knowledge for sound financial planning.

According to Forbes in 2018, America has a serious financial literacy problem. And with it comes dire consequences, such as the following setbacks:

Prior to these figures, Fortune reported that close to two-thirds or 66 percent of Americans couldn't compute basic interest payments correctly. The same report noted that around 33 percent said they did not know how.

While it's important to earn a stable income, how you organize your finances determine your capacity to pay back loans. This is a crucial step that will help build your life and keep you from incurring toxic debt. Without financial literacy, a high salary is useless if you're drowning in debt.

In this guide, we'll teach you about amortization, which is a major component of most loans. We'll discuss how it works, its basic calculation, and other tips that will help manage your debts.

Amortization in loans is an accounting technique used to determine how much of your payment is applied to the interest and principal. It is found in loans with a predetermined principal amount, interest, and loan term.

When loans amortize, it spreads out payments in installments throughout a fixed period of time. Depending on your billing schedule, you may pay 12 monthly payments or 26 bi-weekly payments annually. Whatever payment option you choose, amortization ensures that your interest and principal balance is reduced to zero once your loan term ends.

Beware of negative amortization. The Consumer Financial Protection Bureau warns people against making payments that fail to cover interest. When this happens, your principal balance increases, which leaves you with greater debt.

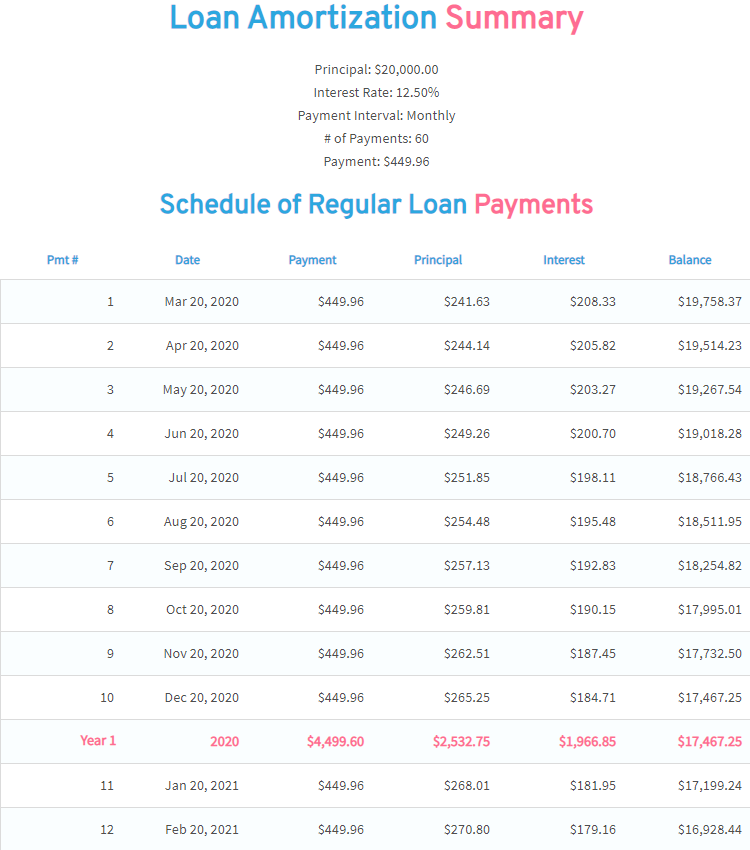

Lenders create an amortization schedule which breaks down every loan payment you make. This is a table which indicates exactly how much of your monthly payment goes toward your interest and principal balance. When you analyze this table, you'll observe how the interest ratio and principal ratio changes over the years. Toward the end of the loan, more of your payment inevitably goes toward the principal.

An amortization table usually shows the following loan details:

You can create your own amortization schedule by using our calculator above.

Below is a screenshot of an amortization schedule showing the first dozen monthly payments on a loan.

Always check your amortization schedule. Loans do not instantly specify the total interest cost. The only way to know the true cost of your loan is to calculate the entire duration of your payments. Once you add the loan amount, interest, down payment, and additional fees, you'll know the real price of your loan.

Loans have three key variables that decide your monthly payment. These variables include:

The principal or loan amount is basically the money you borrowed from your lender. This is one of the first things you must settle before applying for a loan. For instance, if you need to take out a mortgage, is $250,000 enough? Once you figure out the amount, commit to your budget. Larger debt will make your payments harder to manage.

Based on your credit score, lenders may only approve a certain amount. If your credit history has missed or late payments, you'll incur negative points on your credit rating. On the other hand, a higher credit score increases your chances of obtaining the loan amount you need. Take note of this so you can improve your credit score before taking a loan.

Make sure to check your credit history. You may request a free copy of your credit report at AnnualCreditReport.com.

You can pay directly to your principal. Just contact your loan provider to know their arrangement. Paying toward the principal helps reduce your debt, allowing less interest to accrue. Another way is to make higher payments so more of your money is applied to the principal to lower its balance.

As borrowers, our obligation goes beyond merely paying the loan amount. We agree to cover interest charges for the privilege of borrowing money. The interest rate is the cost your lender requires to carry your loan. It keeps financial institutions lucrative so they can keep servicing your loans.

Again, interest rates are offered based on your credit score. The FICO classification system is used by majority of lenders in the U.S., with scores between 850 (exceptional) to 300 (poor). If you have a high credit score of 740 and up, you can obtain better than average rates in contrast to low credit score borrowers. Individuals with low credit standing are offered higher rates because they pose a risk to creditors.

When you think about it, the true cost of a loan depends largely on the interest it generates. And the longer it takes to pay down debt, the more interest it incurs. This means it's more beneficial to pay off your loan sooner.

You can raise your credit score to qualify for more favorable rates. Give it at least a year for improvements to reflect. You can do this by paying bills on time and making lumpsum payments to significantly reduce your outstanding debt. If you have errors on your credit report, you can have them corrected.

The loan term refers to the fixed duration of time you must pay your lender. The length of your loan dictates the number of payments you need to make to pay your debt. Examples of common loan terms are 30-year mortgages and 5-year auto loans.

Misguided borrowers think that extended loan terms with low monthly payments make a favorable deal. But in reality, this is a costly option. Even with lower monthly payments, longer debt incurs more interest charges. This is especially inequitable if you take longer to pay down a new car. Cars depreciate at a rapid rate. If you take a 6 or 7-year term, you'll end up spending more for a car with less value.

Choose shorter terms with monthly payments that fit within your budget. Shorter terms may equate to higher payments, but it helps you eliminate debt sooner. It can also save you thousands of dollars in interest costs.

The down payment is paid upfront to secure a loan. Depending on your budget, borrowers usually prepare around 10 to 20 percent down payment for a car loan or mortgage. A higher down payment helps lessen your loan amount.

Don't forget to factor in the down payment to compute the total cost of the loan. This is useful before choosing a deal. It helps you determine if it's a loan you can afford.

Once you have all the key variables in place, you can now calculate your amortization's periodic payment amount. The following formula is used for regular amortizing payments, including daily, bi-weekly, semi-monthly, monthly, quarterly, semi-annual, and annual payments.

A = P * (r(1+r)n) / ((1 + r)n – 1)

Where:

Let's apply this formula to solve the example below. Suppose you have a house priced at $275,000 and you made a down payment of $55,000. The schedule is 12 monthly payments a year.

Monthly payment:

A = P * (r(1+r)n) / ((1 + r)n – 1)

A = P * (r(1 + r)n) / ((1 + r)n – 1)

= 220,000 * (0.00375(1 + 0.00375)360) / ((1 + 0.00375)360 – 1)

= 220,000 * (0.00375(1.00375)360) / (1.00375)360 – 1)

= 220,000 * (0.00375(3.8476980499634)) / (3.8476980499634 – 1)

= 220,000 * (0.0144288676873628) / 2.8476980499634

= 3,174.350891219816 / 2.8476980499634

= 1,114.707681616952

In this example, your monthly payment is $1,114.71.

For an easier way to estimate your loan's periodic payment amount, use the calculator above.

Based on the previous example, we can now create an amortization schedule. Apply the calculations below to obtain the interest payment, principal payment, and current balance.

Interest Payment – Take the interest rate and multiply it by the loan balance. Then divide it by the number of payments. In this case, divide it by 12 because you have 12 payments in a year.

Principal Payment – Subtract the interest payment from the monthly payment. The resulting amount is applied to reduce the principal.

Current Loan Balance – Subtract the principal payment from the starting loan balance. The result is the current loan balance.

If we repeat this calculation for all the 360 payments of the loan, we can create a full amortization schedule. For example purposes, we'll show a table with the first five payments in contrast to the last five payments for a loan which begins next February with the first payment due in March. See the payment schedule below.

| Payment No. / Date | Starting Balance | Interest Paid | Principal Paid | Ending Balance |

|---|---|---|---|---|

| 1 – Mar 2026 | $220,000 | $825.00 | $289.71 | $219,710.29 |

| 2 – Apr 2026 | $219,710.29 | $823.91 | $290.80 | $219,419.49 |

| 3 – May 2026 | $219,419.49 | $822.82 | $291.89 | $219,127.60 |

| 4 – Jun 2026 | $219,127.60 | $821.73 | $292.98 | $218,834.62 |

| 5 – Jul 2026 | $218,834.62 | $820.63 | $294.08 | $218,540.54 |

| *** | *** | *** | *** | *** |

| 356 – Oct 2055 | $5,509.60 | $20.66 | $1,094.05 | $4,415.55 |

| 357 – Nov 2055 | $4,415.55 | $16.56 | $1,098.15 | $3,317.40 |

| 358 – Dec 2055 | $3,317.40 | $12.44 | $1,102.27 | $2,215.13 |

| 359 – Jan 2056 | $2,215.13 | $8.31 | $1,106.40 | $1,108.73 |

| 360 – Feb 2056 | $1,108.73 | $4.16 | $1,108.73 | $0.00 |

Based on the table above, you'll see that a substantial portion of your loan payment goes toward the interest during the first 5 years. But with each subsequent payment, the principal payment increases by a little over $1. By the 5th payment, $294.08 was applied to your principal while $820.63 went to interest, thus reducing your balance slowly.

By the last 5 payments, you'll see that a large portion of your payment is applied to the principal. On the 356th payment, only $20.66 went to interest cost while $1,094.05 was applied to the principal. This considerably reduces your balance until your debt is completely paid off.

In the end, the mortgage cost $181,293.78 in total interest. If you add your down payment and loan amount (this is excluding other fees and property tax), the total cost of your loan would be $456,293.78.

It's possible to pay your mortgage earlier by making higher payments every month. This will reduce interest charges and shave months or years off your loan. Just contact your lender to ask about their prepayment policy. A lender might charge a high penalty fee for early repayment.

Dealing with multiple debt is a common experience for many consumers. From paying off student loans and financing a car, all the way to maxing out a credit card, it can be hard to prioritize which debt to pay first.

But once you encounter a high-interest loan with punitive fees, you should start prioritizing this debt first. More often, not focusing on high-interest loans like credit card debt can have a grave impact on your finances. Credit collection agencies can also get really stressful, so it's good to get these loans of your back. High-interest loans can eat away income that you could save for emergency funds or other important life purchases. And the longer they go unpaid, they tend to incur larger interest costs. Thus, you should eliminate this type of debt as quickly as possible.

Wiping off high interest loans also decreases your credit utilization ratio. This is basically how much debt you owe relative to how much money you can spend. A high credit utilization ratio indicates risk of being unable to pay back a loan. To stay safe, you should ideally borrow no more than 30 percent of your total credit.

Moreover, removing credit card debt is a great factor that can help improve your credit score. Around a third of FICO ratings are associated with how much borrowers owe creditors. Revolving credit from bankcards are reviewed more than other types of debt. And once you have better credit standing, you will be eligible for future loans.

Debts that you can pay down later include low-interest loans, such as student debt and mortgages. But once you eliminate costly credit card debt, you'll have extra money to prioritize these types of debt next. With patience and good financial management, in time you will be able to wipe out your debts completely.

Debt consolidation is a repayment strategy that merges high interest debt like credit card balances into a single payment. It is done to lower your interest rate and help manage your payments easily. This can reduce multiple debts and help pay them down sooner.

Debt consolidation makes sense if you commit to a plan that will help you stay out of debt. It also helps if you possess the following attributes:

On the other hand, debt consolidation might not be the best option if your total debt is not that large—less than $10,000. In which case, you're better off paying them individually. Otherwise, you'd only save a trivial sum for consolidating. You can try using the avalanche or snowball method to pay off your debts, whichever works well for you.

Another scenario is if your overall debt amounts to more than half of your income. In this case, it might be wiser to seek out debt relief options. This will impact your credit history for years, but it can work better than struggling to pay debts you can no longer afford. At the end of the day, trust yourself to choose the right option for your needs.

Taking the time to learn basic financial management has plenty of rewards. Beyond saving, it helps you make smart decisions when it comes to planning your repayment strategy. It also makes you more conscientious about spending your hard-earned income so you can investment in worthwhile purchases.

Knowing how amortization works is crucial in understanding the true cost of borrowing money. If you're about to take a loan, checking the amortization schedule will help you steer clear of deals you can't afford.

Need help figuring out an interest-only mortgage? Use our interest-only loan payment calculator.

Jose Abuyuan is a web content writer, fictionist, and digital artist hailing from Las Piñas City. He is a graduate of Communication and Media Studies at San Beda College Alabang, who took his internship in the weekly news magazine the Philippines Graphic. He has authored works professionally for over a decade.