Amortization

Biweekly Payments

Interest Only Payments

Loan Payment Calculator

Loan Payment CalculatorUse this calculator to quickly estimate the monthly payments on a loan. Enter the amount borrowed, any application fees, the loan term & interest rate charged on the loan. This loan also enables you to calculate payments on a loan which has a balloon payment due at the end of the term.

When you are done with your calculation you can use the button at the bottom of the calculator to create a printable amortization schedule.

Guide published by Jose Abuyuan on March 3, 2020

Consumer loans are necessary for boosting economic growth and helping people build lives. Different types of consumer financing enable us to obtain major expenses, such as housing, education, and even healthcare needs.

But while obtaining loans are a sign of a thriving economy, large outstanding debt exacts risk to consumers. The longer debt goes unpaid, the more costly it gets. And when emergency situations arise, this leaves borrowers severely vulnerable to financial loss and default.

CNBC reported that 77 percent of Americans said they feel anxious about their financial situation. And based on the same survey, Americans are most worried about the following financial issues:

Lack of funds to retire

Keeping up with the cost of living

Managing debt levels

Over the years, these financial problems take their toll. It's important to learn how to address them as early as possible. And for those facing bankruptcy, knowing your options will help you decide which assets to maintain or let go. Eventually, once you recover, you'll be able to free up income that can go toward your savings.

In this guide, we'll review the different types of consumer debt and how large each one is on a relative basis. We'll also discuss how each type of loan is treated under bankruptcy, and what you can do if you want to keep your assets. Finally, we'll talk about effective debt repayment strategies every borrower should know.

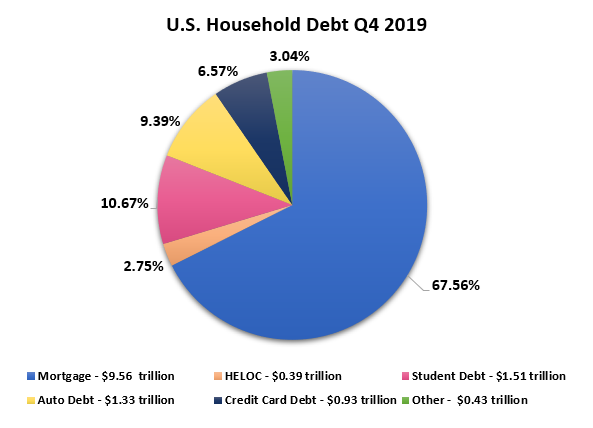

For the first time, the total U.S. household debt exceeded the $14 trillion mark in 2019, according to the Federal Reserve Bank of New York. From $13.95 trillion in Q3 of 2019, household debt rose to $14.15 trillion in Q4 of 2019. That's an increase of $193 billion or 1.4 percent in one quarter.

The table below shows how household debt figures changed between Q3 and Q4 of 2019.

| U.S. Household Debt | Q3 2019 | Q4 2019 |

|---|---|---|

| Mortgage | $9.44 trillion | $9.56 trillion |

| HELOC | $0.40 trillion | $0.39 trillion |

| Student Debt | $1.50 trillion | $1.51 trillion |

| Auto Debt | $1.32 trillion | $1.33 trillion |

| Credit Card Debt | $0.88 trillion | $0.93 trillion |

| Other | $0.43 trillion | $0.43 trillion |

| Total Household Debt | $13.95 trillion | $14.15 trillion |

*2019 Q4 and Q3 figures sourced from the Federal Reserve Bank of New York

At the forefront of increasing household figures are mortgage debts. The New York FED stated that mortgage originations rose to the highest volume seen since Q4 of 2005, from $528 billion in Q3 to $752 billion in Q4 of 2019. This is attributed to many borrowers refinancing home loans due to falling interest rates.

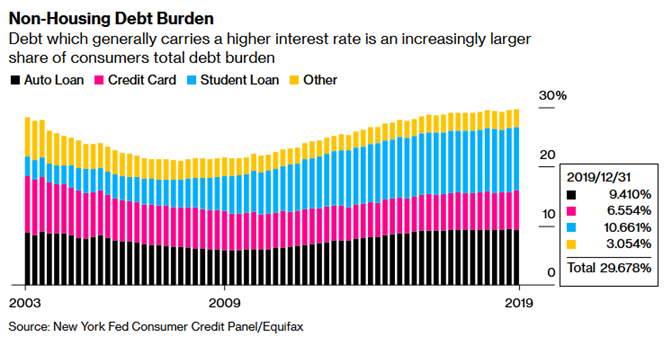

Mortgage debt is followed by student debt, auto debt, credit card debt, and other loans. In a related report by CNBC, consumers are likely to spend around 10 percent of their disposable income on non-mortgage debts such as student loans, auto loans, credit card debt, and personal loans.

The graph above shows how non-housing consumer debt changed from 2003 to 2019. Notice how student debt started as the lowest shareholder in 2003, with auto loans taking most of non-housing debt percentage. But by 2019, student loans have taken the largest portion of non-housing debt, followed by auto loans and credit card debt.

The difference between secured debts and unsecured debts affects what happens to your assets during bankruptcy. Secured debts are backed by collateral such as houses, cars, stocks, and insurance policies. These assets can be repossessed by your lender to regain funds in case you default on your loan. Common secured debts include mortgages and auto loans.

Meanwhile, unsecured debt is not tied to any collateral like a house or a car. The only guarantee a lender relies on is a borrower's creditworthiness. Without any assets to seize, lenders put up with greater risk. Common types of unsecured debt include personal loans and credit cards. Credit cards provide revolving credit and tend to have higher interest rates.

Researching different types of financing to qualify for a loan? Learn the advantages and drawbacks of different loans by reading our guide and using our compare loans calculator.

Mortgages are the largest component of consumer loans, comprising 67.56 percent of total household debt. Housing debt increased to $9.56 trillion in Q4 of 2019, which is $120 billion more compared to Q3.

The year 2019 is the time when more people in the age of 30 obtained mortgages, with $210.1 billion in Q4 of 2019. The New York FED says this is the highest figure seen in the demographic since the last quarter of 2005. Mortgage originations by young adults aged 18 to 29 were also high, the largest seen since Q3 of 2007.

By the end of 2019, 1.0 percent of mortgage balances fell more than 30 days behind on payments, which means they've transitioned into delinquency. Meanwhile, 17.4 percent of mortgages that had 30 to 60 days of late payments in Q3 transitioned into seriously delinquent borrowers by Q4 of 2019. Serious delinquency indicates they are more than 90 days late in mortgage payments.

Overall, a total of 71,000 borrowers received new foreclosure notations to their credit histories. According to the New York FED, this is a low number compared to historical figures.

Filing a bankruptcy discharge is meant to remove personal liability on most types of debt. It's the last resort for people who are struggling with overwhelming financial problems.

However, for mortgages, it does not instantly wipe out liens from your home. A mortgage is a type of secured debt, which means a lender can take the property to recoup the borrowed funds.

Often, the lender's right to foreclose your property remains even after bankruptcy. If you default on your loan, your house will go to the foreclosure auction where it's put on sale to cover your debt. If the house does not sell there, the lender takes possession of the property.

To keep your home, you must continue paying your mortgage during and after the bankruptcy period. Filing for bankruptcy eliminates other debt obligations which allow you to prioritize making continuous mortgage payments. But to keep making payments, you must reaffirm your mortgage.

Reaffirming your debt means signing a new contract at the bankruptcy court that makes you personally liable on the loan again. It foregoes the benefit of your bankruptcy discharge, stating you promise to repay a portion or all of your debt.

Take note, however, that mortgage lenders may not let you reaffirm your loan if you are delinquent on your payment when you file for bankruptcy. But depending on your lender, they may allow you to put a delinquent balance at the end of the loan and then let you reaffirm it.

Need to quickly estimate monthly payments on your loan? Use our loan payment calculator on top of this page. You can also generate an amortization schedule.

Bankruptcy damages your credit history by remaining in your records for up to 10 years. It also does not usually apply to debt obligations such as student loans, tax debt, and child support. It also does not remove debts acquired through fraud and debts involving wrongful injury or willful injury cases. Bankruptcy also freezes your credit record, preventing you from applying for new credit while your case is pending. Unless you've exhausted all your options, do not file for bankruptcy.

Educational debt is the second largest factor making up around 10.67 percent of total U.S. household debt in 2019. Student debt rose to $1.51 trillion in Q4 of 2019, making it $10 billion more in contrast to Q3. Bloomberg states that over $100 billion student debts are made by people ages 60 and above. This indicates that a growing number of borrowers are taking longer to pay down educational loans.

According to the Federal Student Loan Portfolio, loans in default amounted to $5.2 million in Q1 of 2019. By Q4 of 2019, 1 out of 9 borrowers are in default or 90 days or more behind in payments. Around half of student loans are presently in deferment (while not paid, the government shoulders the loan's interest) or forbearance (where the loan continues to accrue interest). These borrowers opted to delay monthly payments because they are temporarily unable to afford the costs. The New York FED states that delinquency rates are likely to double once these loans go back into the repayment cycle.

In total, 11.1 percent of borrowers with student loans in 2019 concluded the year seriously delinquent or in actual default.

Student loans are not typically removed when people file for bankruptcy. Under U.S. law, student loans are one of the hardest to discharge compared to other types of unsecured debt.

To get student loans removed, you must file a separate action known as an ‘adversary proceeding' when you declare a Chapter 7 or Chapter 13 bankruptcy case. According to the Federal Student Aid, an adversary proceeding is a request in the bankruptcy court to consider how student loan repayment “imposes undue hardship on you and your dependents.” In short, you must prove that your condition merits loan removal.

While bankruptcy courts do not use standard qualifications to determine ‘undue hardship,' they are likely to review the following factors:

If the court finds that repayment causes you undue hardship, you should expect one of the following outcomes:

Getting student loans discharged is a taxing process, but it's worth the shot even if you get it partially discharged or with different terms.

If your student loan was not discharged, the Federal Student Aid recommends shifting to an alternative repayment plan that can better suit your needs. Just contact a loan servicer to talk about different repayment plan options or changing your repayment program.

Car loans account for 9.39 percent of U.S. household debt in 2019, the third largest in consumer debt. It increased by $16 billion in Q4 of 2019, resulting in $1.33 trillion. Auto loan originations generated $159 billion, with an overall increase of 9.9 percent.

Originations to borrowers with subprime credit, or those defined by the New York FED with credit scores below 620, were at $31 billion. However, the subprime share went up by only 0.2 of the overall percentage point. Meanwhile, auto loans to super-prime borrowers or people with credit scores 760 and up increased by 15.3 percent compared to the previous year. This represents a 34.7 percent share in total auto loan originations.

While there was an increase in subprime and prime-risk borrowers, the biggest boost in 2019 was still mostly among qualified car buyers with high credit scores.

The transition rate into serious delinquency in car loans increased from 2.34 percent in Q3 of 2019 to 2.36 percent in Q4 of 2019. Bloomberg also reports that close to 5 percent of auto loans are 90 or more days delinquent. It is the highest since Q3 of 2011.

Filing a Chapter 13 bankruptcy case allows you to keep your property, including your car, while still paying back a portion of your debts. With a reorganized payment plan, Chapter 13 bankruptcy allows you to pay some debts in full and make partial payments for other debts. And even if you have late payments, you can still make up for them. On the other hand, if you file a Chapter 7 bankruptcy case, you have several options which may allow you to keep the car or let the lender repossess your vehicle. These options include the following:

1

Reaffirming your auto loan. Just like in mortgages, you must reaffirm your loan to verify that you intend to continue making payments to keep the car. Once you do this, you can sign away other property and get your other debts discharged while keeping the car. Just remember that the lender can still repossess your vehicle if you fail to make the payments.

2

Redeeming your car. You can keep your car if you come up with a way to completely pay off your car's balance. It's not the easiest option given the high lumpsum payment. However, there are consumers who are able to secure funds from family or friends to keep their car.

3

Surrendering your unit. If you choose to surrender your car, you can directly return the unit to the lender. You just need to obtain a legal document that proves you surrendered the car. The lender will then sell it for less than the amount your borrowed.

When you surrender your car under bankruptcy, the lender sells it for less than the amount you owe. This incurs a ‘deficiency balance.' You must pay for this remaining balance during your bankruptcy.

Credit card debt rose to a record high by the end of 2019, with a considerable portion of borrowers behind on payments. The total credit card balance grew to $930 billion in Q4 of 2019, that's an increase of $46 billion from the previous year. The Wall Street Journal reports that this is way above the previous peak prior to the 2008 financial crisis.

Credit card users, specifically the younger ones, are driving delinquency rates. Payments late by 90 days or more rose to 5.32 percent in Q4 of 2019 from 5.16 percent in Q3 of 2019. The delinquency rate for credit card holders between 18 to 29 years old increased to 9.36 percent. This is the highest since levels seen in Q4 of 2010, which is 8.91 percent. The New York FED notes that delinquency among young credit card users has been steadily rising since 2016.

For many struggling borrowers, credit card debt is one of the major reasons they file for bankruptcy. And if you file a Chapter 7 bankruptcy case, almost all your credit card debt can be wiped off. Credit card debt is unsecured debt, which means it is not attached to any asset like a house. This technically keeps lenders from seizing any of your property to recoup the amount you owe.

However, credit card companies may file a debt collection lawsuit against you to exact a personal judgment. Once personal judgement is rendered against you, you are obligated to pay back your lender no matter what. This also means they can recover monetary damages through your property.

Moreover, once you file for bankruptcy, you cannot keep your old credit cards. Any active credit card account, even with zero balance, loses borrowing benefits once your lender matches it with a bankruptcy case.

What if I don't list the credit card because it has zero balance anyway? If you don't include it in your bankruptcy file, it will not be discharged. Most courts will also not discharge the undeclared account in a future bankruptcy. This means you are liable for payments if you rack up a balance on the unlisted account (even if you promise not to use it). To be extra safe, include the credit card in your bankruptcy file.

There are non-dischargeable credit card debts that cannot be resolved through a Chapter 7 bankruptcy case. Some of these include credit card charges for luxury goods and services, which refer to things that consumers do not necessarily need. Bankruptcy also cannot discharge credit card debt used to pay off taxes, student loans, child support, and alimony.

In recent years, personal loans have become one of the fastest growing type of consumer financing in the U.S. The number of people who have personal loans doubled in 2019 compared to 2012. Experian states that there are 38.4 million personal loan accounts as of October 2019. This is an 11 percent year-over-year increase compared to 2018. The outstanding personal loan debt in Q3 of 2019 is estimated at $156 billion.

While personal loans may be growing faster than most types of consumer debt, it only represents around 1 to 2 percent of total U.S. consumer debt in dollars.

The table below highlights average personal loan balances per age group in Q2 of 2018 and Q2 of 2019. The figures are taken according to the generation when borrowers were born:

| Generation | Year | Q2 2018 | Q2 2019 |

|---|---|---|---|

| Gen X | 1965-1979 | $9,722 | $17,175 |

| Baby Boomers | 1946-1964 | $8,530 | $19,253 |

| Millennials | 1980-1994 | $7,374 | $11,819 |

| Gen Z | 1995-present | $3,340 | $4,526 |

Data from TransUnion (Q2 2018) and Experian (Q2 2019)

Based on the data above, people born between 1965 to 1979 (Gen X group) have the highest average personal loan debt in 2018, followed by Baby Boomers and Millennials. The youngest group, Gen Z, has the lowest average personal loan debt. By 2019, Baby Boomers are at the top with $19,253, followed by Gen Z at $17,175. Millennials' average personal loan balance increased to $11,819 but is still 39 percent lower compared to the average Baby Boomer balance. Gen Z's average balance also rose to $4,526, which is around a 35 percent increase compared to their average balance in 2018.

About 3.39 percent of personal loan borrowers are delinquent or 60 days late in payments as of Q4 of 2019. This rate is the highest compared to delinquency rates in credit cards (1.8%), auto loans (1.4%), and mortgages (1.5%). TransUnion data in Q2 of 2018 shows that Gen Z has 6 percent delinquency rate, which is the highest delinquency rate recorded among all age groups. Despite the growing number of personal loans in the past few years, the delinquency rate has remained between 3 to 4 percent.

Personal loans are among the types of debt commonly discharged when you file for bankruptcy. Chapter 7 bankruptcy involves cancellation of most debts, including personal loans, medical bills, balances from collection agencies, unpaid utility bills, dishonored checks, business debts, as well as civil court fees. Whether you obtain personal loans from banks, your family, friends, or employer, your debt can be released if you qualify for Chapter 7 bankruptcy. Under this bankruptcy case, you can liquidate or sell your assets to your lender to pay back a portion of your debts.

Unsecured debt such as unsecured personal loans may be discharged under a Chapter 7 bankruptcy case, but not with a Chapter 13 bankruptcy.

Under Chapter 13 bankruptcy, the court provides you with a mandated repayment plan. It does not cancel debts but helps you rearrange your finances. However, there are some exceptions. If the repayment plan is implemented to the court's content, your other debts may be forgiven or canceled.

Organizing debt payments is a highly valuable skill. Unfortunately, many consumers struggle with monthly payments and how to compute their loans. You might take it for granted, but organizing your finances and reviewing basic loan calculations ensures you can pay debts on time. And even if you're forced to file for bankruptcy, applying effective loan repayment methods can help you keep your house or any important asset (especially when you reaffirm your loan) in the long run.

To reduce your balance and pay down debt, here are 5 debt repayment strategies you can do now:

Create a debt repayment plan that motivates you to reach your goal. Whether you choose to focus on eliminating high interest debt or small balances first, it's important you feel driven to maintain healthy financial habits. To make your debt repayment plan, follow these steps:

Make more than the minimum payment on your loans. This helps reduce your debt faster because more of your payment goes to the principal rather than interest. This is especially true for credit cards. In fact, only paying the minimum percentage per month can drive you further into credit card debt.

The next step is to set a budget that works for you. Create budget categories so you can track how much you are spending on each group. For instance, let's supposed your general budget categories include housing bills, food, gas, and hobbies.

When you're on a tight budget, you might want to consider foregoing hobby expenses for a while to prioritize loan payments. And if you spend too much money eating at restaurants, make an effort to cook or eat at less costly establishments. The goal is to tailor your financial plan so you can set aside money for your loan payments.

To wipe out debt faster, try to make additional payments. You can make a projection table of how much extra money you need to make to pay down your loan sooner. To give you an idea, see the table below:

| Loan details | Minimum Payment | Additional $40 |

|---|---|---|

| Monthly payment | $210 | $250 |

| Total interest | $3,564.86 | $2,740.74 |

| Total repayment amount | $12,564.86 | $11,740.74 |

| Number of payments | 60 | 47 |

| Est. pay off time | 5 years | 3 years & 11 months |

Based on the table, if you make a minimum payment of $210 on your loan, it will take you 5 years to pay it off. But if you add $40, which is $250 per month, you can pay down your loan in 3 years and 11 months. With the minimum payment, you'll spend $3,564.86 in interest. But by adding $40, you'll only spend $2,740.74 in interest, saving you $824.12.

Once you have your payment plan arranged, make sure to implement it. To make it more convenient, you can automate monthly costs to your focus debt. Just contact your bank so they can set it up for you.

Meanwhile, make sure to make monthly payments to your other accounts. If your budget does not permit you to make extra payments to your other loans, it's okay. You can make minimum payments for the time being. Once you have extra funds, you can add extra payments now and then. But make sure to eliminate your focus debt first so you can move on to prioritizing the next loan.

Never miss a due date. Missing payments can put you at risk of delinquency for any loan. If you miss payments for a credit card, your creditor will impose penalty fees or even increase your interest rate. This will make it more difficult to reduce your balance.

Reducing your debt means you need to stop creating more debt. Be wise and stop using your credit cards. Even a few swipes can rack up a substantial balance, so it's best to put it out of sight. Some people literally freeze their credit cards, while others even cut them up, promising to never use them again. If you think closing your account will help, then go for it. Whatever method you choose, just make sure to stop swiping your credit card.

The best way to go is to pay with cash or a debit card instead. Be more conscientious of how you spend your money. With actual cash, you won't be tempted to spend credit that you do not have. It will help you stick to your budget and plan more frugally.

Aside from cutting your expenses, thinking of ways to earn extra income will help you wipe out your debt.

This can be as simple as selling your pre-loved goods at a garage sale, or doing side-jobs during your free time, such as baby-sitting for the neighbor or selling baked goods at a weekend market. You can also clock in more overtime work to boost your salary. If you enjoy writing, editing, graphics design, and other creative activities, you can try doing creative freelance work. Explore the job market and look for potential clients looking to commission a job.

While looking for extra funds, do not allow any side-gig to interfere with your main work. If the opportunity cost is too high and stressful to take on another job, drop it. You should prioritize keeping a stable job.

Dealing with debt is stressful and it usually involves major changes in people's lives. In many cases, people get mired in debt because of a costly divorce process or staggering medical bills due to an illness or emergency. But even with a dire financial situation, it helps to do your research and know your options so you can recover from debt.

We know it's easier said than done, and it really takes time. But what's important is you are continuously making improvements to live a debt-free life.

Need more information about managing your debt? Read our guide and use our accelerated debt repayment calculator.

Jose Abuyuan is a web content writer, fictionist, and digital artist hailing from Las Piñas City. He is a graduate of Communication and Media Studies at San Beda College Alabang, who took his internship in the weekly news magazine the Philippines Graphic. He has authored works professionally for over a decade.