Savings Goals

Net Worth

Savings Goal Calculator

Savings Goal CalculatorUse this calculator to figure how much your current savings will grow and how much more you'll need to add regularly in order to achieve your savings goal in a set period of time.

Guide published by Jose Abuyuan on October 6, 2020

Savings is an essential part of your financial security. Besides covering unforeseen expenses, it makes major life goals possible. The money you set aside today helps pay for your future home, car, or entertainment system. A world of possibilities await with every dollar saved.

While saving in increments is important, leftover income is not enough to build a comfortable life. You must actively budget your savings to reach your financial goals. Without proper planning, it may feel like an eternity. Such slow progress can kill your motivation, consigning your goals to fantasy.

To achieve your financial goals, you must kick your savings up a notch. Set intelligent and quantifiable goals to build your budget around them. This way, you can reach them faster and see where your progress is going.

If you’re already saving money, congratulations! You’ve made the first step toward reaching your financial goals. Being efficient with your savings is the key to sustaining your momentum and building income faster with less effort. Before we begin, ask yourself the following questions:

Of these, the last two questions are usually the easiest to answer. For some, they save for a very specific purchase such as a home in the suburbs, a decent car, or a new Nintendo Switch. Others have far vaguer goals such as “retire in comfort” or “financial security.” People keep their savings in their homes, at least at first. Eventually, they put them in savings accounts for safe keeping.

Most consumers have yet to go past the “save whatever is left” mentality, and with good reason. Due to inflation, making ends meet has become more difficult over the years. Money is often spent as fast as it comes. You’ll need careful planning to get out of that rut and build wealth.

Make it your first goal to set aside part of your income. While you can start small, be prepared to increase this amount to meet major milestones. Far too often, we save what we left behind after the end of each month, as expressed here:

Income – Expenses = Savings

This doesn’t give you much wiggle room to increase your savings as needed. The sporadic nature of your expenses might leave you with little left to save. Ideally, you should treat your savings as one of your major expenses. Here’s how it ought to be:

Income – Savings = Expenses

For instance, let’s assume you have an income of 5,000 a month. You make it your goal to save $500 each month. Here’s how you should budget.

$5,000 – $500 = $4,500

The rest of your money must fit into the remaining $4,500. For many people, this isn’t as easy as it sounds. You’ll need to budget to meet your minimum savings. As your goals change, you may need to alter your budget to earn more money. But how much of your income should you set aside at the start? Well, it depends on how much your essential spending will allow.

You must assess where your money is going. Are you spending too much on wants and luxuries? Do you often use credit cards to tide you over? Ask yourself serious questions on the necessity of all your expenses. You should focus your finances on costs that are truly necessary. Pare it down to the bare essentials:

On occasion, you might find that you’re paying for things that you don’t really use. Maybe that cable-phone-internet bundle wasn’t a worthwhile deal. Neither was that old gym membership you never actually use. Take a cue from the decluttering show and get rid of expenses you don’t enjoy or use. You’d find that you won’t really miss them.

Once you’ve figured out what’s essential and what isn’t, you can work on building a budget. For practical considerations, you must define a starting savings budget. Make sure you have ample money for both your basic needs and your savings. What’s left after prioritizing essential costs are discretionary expenses. If necessary, reduce your non-essential spending as much as you can, especially if times are tough.

How much money should you allocate toward your budget? The answer is complex. Most often, you’d hear conflicting advice on the exact income percentage for savings. Older advice says that 10 percent is enough. Most financial experts today, however, prefer 20 percent. Let’s look at the pros and cons of both.

Our first example used the 10 percent increment for a reason. For those starting out, it’s a good number to work for. Thus, it became the standard for a long time. On the down side, this doesn’t give you a lot of leeway to use your savings. Often, you’ll need to work on your goals one at a time.

On the other hand, saving 20 percent is difficult. It might be too high a number for people starting out. But it does have several advantages. Saving more money on the onset lets you meet your financial goals faster. A 20 percent savings plan can help you split your income between retirement, debts, and emergencies. You set aside more money for a specific goal without neglecting the others.

A larger savings amount also works in your favor come retirement. You won’t save as much money with 10 percent, nor can you consider retiring early. By saving 20 percent, you earn a greater amount of interest on your savings. This can pave the way for a more comfortable retirement later in life.

You should use personal finance rules as guides, but be prepared to alter them as your situation demands. One of them is the 50/30/20 savings rule. This popular guide is endorsed by politicians and financial experts alike. The rule stresses the need to clarify your spending priorities. Under this method, you should divide your money according to three purposes:

This simple allocation lets you have some money for your personal enjoyment. It has its limits, however. You cannot always fit all your essential expenses into 50 percent of your income, especially if you live somewhere expensive. For instance, you’ll likely take 10 to 15 percent from discretionary expenses to make up for essential needs. While you don’t have to follow the rule strictly, you can use this guide as a template. Alter it as needed and get as close as you can.

The best way to set savings goals is by making quantifiable milestones. This divides your main tasks into steps you can work on in a realistic time frame. Quite fittingly, this is called the SMART goal setting method, based on its key objectives:

| Objective | Description |

|---|---|

| Specific | Be clear with your goal. Know what to aim for and stick with it. |

| Measurable | A savings goal should have a definite cash value. This way, you can see how much you’ve progressed toward it. |

| Attainable | Make your goal realistic and doable. Break big, lofty goals down into tiny pieces that you can work on with ease. |

| Relevant | Your savings goals serve a purpose that helps you out in some way. |

| Timebound | This goal must be reasonably accomplished by a defined period. It will be based on how much money you can afford to set aside. |

Under these guidelines, the first goals you set must be small. Accomplishing small goals first builds your confidence and keeps you from getting overwhelmed. You can then work your way up toward bigger goals.

For our example, we’ll assume you make $60,000 a year, or about $5,000 a month. You’ve recently opened a savings account with an annual percentage rate (APR) of 0.6 percent with a maintaining balance of $300. You pledged to save every payday, which is every two weeks.

Your first goal is an emergency fund. Let’s say, you want to save a month’s worth of income as a starter fund. Using our calculator above, let’s see how much you’ll need to save to earn that amount in half a year:

| Category | Value |

|---|---|

| Current Savings Future Value | $301.80 |

| Total Savings Gap | $4,698.20 |

| Biweekly Savings Goal | $360.90 |

To reach your goal in six months, you must save almost $361 every two weeks.

If you’re just starting out, you won’t always have enough money to pay for everything. Thus, it becomes important to rank your savings goals according to your needs. To rank your needs, you’ll need to look at how soon you must obtain them and how necessary they are.

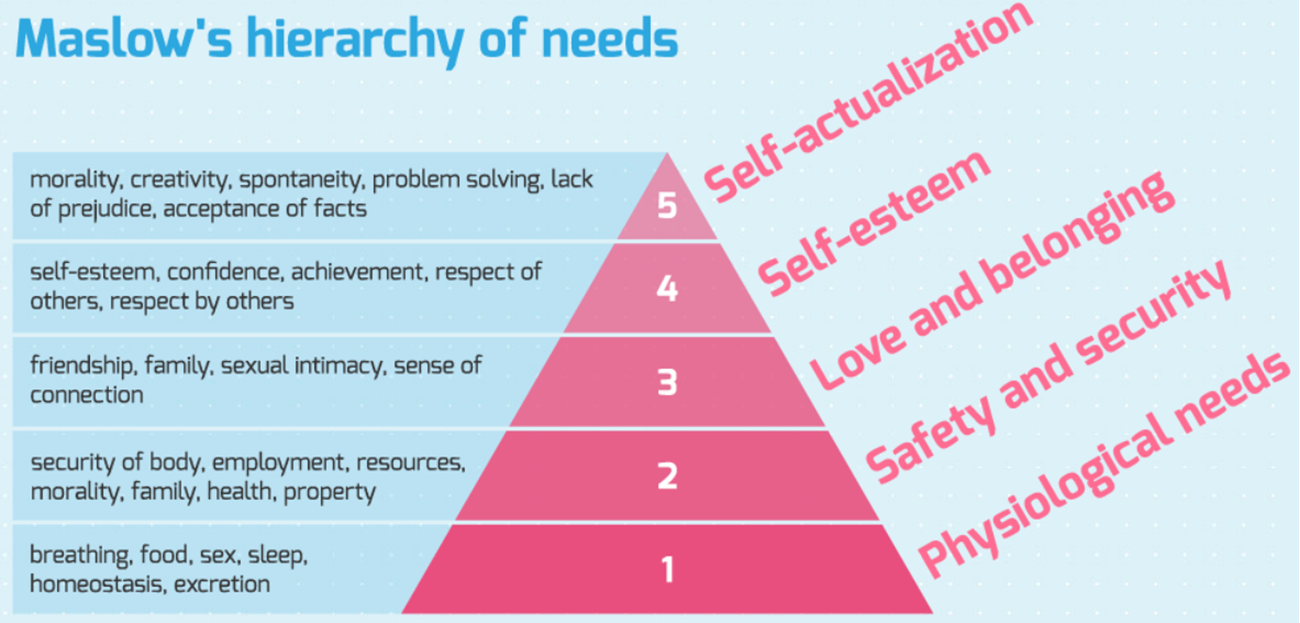

Coined by Abraham Maslow in 1943, the Hierarchy of Needs arranges many of your goals and aspirations according to how essential they are. This model became a vital cornerstone of personal development and motivation. You can’t accomplish many life goals without meeting some of your more basic needs.

The hierarchy of needs takes the form of a pyramid with five tiers. The first two layers (survival needs and personal security) comprise the bottom of the pyramid. The next two layers, love and self-esteem, fall in the middle. At the top is self-actualization, the fulfillment of your major dreams and life goals.

Love and self-respect are things you can never buy with money. What you can do is use your savings to support yourself and the people you love. The returns of that investment are incalculable.

Pigly's Tip!

Maslow’s hierarchy places the bottom-rung needs ahead of the others. Before you even consider your purpose in life, you must make sure that you have a roof on your head and food on the table. Subsequently, it’s also an excellent template for arranging your financial goals. Your first goals should secure your immediate wellbeing. Your major life plans beyond that should be the very last.

Rank your savings goals by their urgency. Focus your savings on your most pressing needs. In most cases, this will be your emergency fund. It will cover essential costs and unexpected expenses during times of crisis. At most, you’ll need between three months to a year’s worth of income stashed away. You’ll never know when you might need it.

Your goals should be sorted according to their importance and the time it takes to save up for them. Short-term goals, which can be done within a year, take precedence over those that take years or decades to accomplish.

Let’s return to our first example. The table below lists down your the major goals if you’ve recently married and are expecting children. They’re arranged according to their immediate importance from top to bottom. We’ll also assume that you have debts to pay off, of which you can add an extra $1,200 a year. These goals will change depending on your age and financial status. Figures with an asterisk represent annual costs:

| Goal | Amount | Notes |

|---|---|---|

| Starting Emergency Fund | $2,500 | You must save more than this during an economic crisis. |

| 1-Month Emergency Fund | $5,000 | |

| 6-Month Emergency Fund | $30,000 | |

| Accelerated Debt Payments* | $1,200 | |

| Car Down Payment (20%) | $3,945.60 | Based on the price of a 2020 Toyota Corolla |

| Car Cash Payment | $19,728 | Based on the price of a 2020 Toyota Corolla |

| Home Down Payment | $62,640 | Based on the median home price during the second quarter of 2020 ($313,200.00) |

| 401(k) Retirement Fund* | Max. $19,500.00 per person | The catch-up contribution limit is $6,500 for people aged 50 and above. |

| Traditional Individual Retirement Account (IRA)* | Max. $6,000.00 per person | The limit is extended by $1,000.00 if you are 50 years old and above. It applies to both Traditional and Roth IRAs. |

| 529 College Education Plan* | Max. $15,000 and $30,000 to avoid gift taxes |

Here are a few things to remember about the goals listed above:

You can also create a separate line of savings for your wants. Keep them distinct from your essential savings and draw them from your disposable income.

| Savings Goal | Amount |

|---|---|

| Nintendo Switch | $300.00 |

| Bahamas Vacation Fund | $1,000.00 (per person), $4,000.00 for a family of four |

| Home Theater System | $17,500.00 |

Be flexible with your long-term savings goals. Some assets, like real estate, grow in value over time. It’s best to save more money to factor in future price increases. Anticipate these changes when you’re goal setting.

Let’s also look at where you’re stashing your cash. As kids, most of us learned how to save money by putting away savings in a safe container. It could be a jar with a label, a piggy bank, or a sock under your mattress. But it’s still the same concept.

Leaving your savings at home puts it at risk of being stolen or spent. The temptation to use all that money for an impulse buy might be too great. Plus, your money doesn’t earn interest and will lose value to inflation. As soon as you can afford it, move that money to a savings account.

Savings accounts are the superior choice when it comes to putting your money away. Unlike checking accounts, these have a limited amount of free withdrawals. Because you face stiff penalties, you are less likely to draw from it with regularity. Besides being safe, savings accounts also help your savings grow. These accounts earn interest, often at a higher rate than checking accounts. This isn’t much at first (on average around 0.06 percent), but it will help you further down the line.

High-interest savings accounts are an excellent choice for large, long-term savings goals like down payments for a home or car.

To put it simply, compounding interest is interest on interest. With every compounding period (often a month), your account adds the interest you’ve earned into your principal. This, together with your deposits, earns a much higher interest over the next period. Compounding continues as long as your money remains in the account.

Compounding takes some of the work out of reaching your savings goal. It puts your money to work for you. Over time, the amount of interest you earn from your savings grows, with little extra effort on your part.

As the saying goes, the best time to save was yesterday. Starting early, your humble contributions can lay the foundation for financial security. Thanks to compound interest, the savings you make today will pay generously for your needs tomorrow.

Some of the best APRs are available from online-only savings accounts. These and smaller institutions offer customers much higher rates to attract more investors. Some banks offer up to 2 percent when rates are high. Even a 1 percent APR can offer a large yield, which can help you reach your savings goals faster and with less effort.

Choosing the right online bank is critical, and it’s important to look beyond the APR. A good bank has little to no maintenance fees and an excellent track record for customer service. Another feature to watch out for is maintaining balance. A few banks offer low to no maintaining balance or minimum deposit amounts when you open an account with them.

Extra payments toward your debts are considered part of your savings. By clearing your debts faster, you’ll save a lot of money on future interest payments. Debt payments are one of the lowest-risk investments you can make. By paying more money on debts today, you’ll lower your debt obligations permanently.

Debt payments often outperform investments in the short term. A good way to see this in action is comparing the APRs of your highest debts and your investments. If your most expensive debts have rates in the double digits, you save more money by paying extra toward them.

The best way to clear your debts is to pay them off one at a time. As one debt is cleared, you can use the money to pay the next debt in line. Once you’ve cleared off your debts, you’ll free up your cash flow. You’ll have more money to build your savings. And with a little extra, you can even treat yourself and your family.

Clearing your debts faster improves your credit rating. As you improve your credit score, you become eligible for lower interest rates. This can help you save more money when it’s time to buy a house or a car.

To build wealth, you must make lucrative investments. In most cases, investing is paying for a stake in someone’s business. When they profit, you profit. Becoming a business’ co-owner is a straightforward example. Stocks are the logical extension of that, being a stake in a corporation. A lucrative business can offer immense returns, but only if they succeed.

Thus, investments come with risks. All forms of investments are classified according to the amount of risks they possess. The chart below is based on a Harvard study tracking the real rates of return from four main asset classes between 1950 to 2015:

| Asset Class | Real Rate of Return |

|---|---|

| Treasury Bills | 0.88% |

| Bonds | 2.79% |

| Equity (Stocks) | 8.30% |

| Housing (Real Estate) | 7.42% |

As a rule, risk is related to returns. The higher the risks, the greater the returns. Stocks are the most familiar of high-risk investments. While the value of a company goes up in the long term, it rises and falls on a daily basis. For long-term gains, you get high short-term risks. In contrast, bonds have lower risks. You’ll know you’ll get your money eventually. But it wouldn’t have grown that high. And because it is based on a cash amount, its risk is tied to inflation. As money loses value, so would your returns.

Everyone’s tolerance for risk varies. How much you can afford to lose in the short term is dictated by many factors, including length of time and financial stability. A young person can afford to wait out the market longer than an older person. However, entry-level workers make less money than established ones. Meanwhile, older people can afford to take riskier investments since they tend to have more diverse wealth. Thus, your risk tolerance will vary over your lifetime.

To manage risks, you must diversify your investment portfolio. This means having more than one type of investment. The proportion of these investments within your portfolio is your asset allocation. How much of your money goes to each asset will depend on your tolerance for risk. If you have less risk tolerance, invest more on bonds and other low-risk assets. If you can take the risks, choose riskier assets like stocks.

Over time, the value of your assets grow. You might find that you now own more stocks than your asset allocation allows. Instead of riding this brief windfall and buying more stocks, rebalance your assets. In this case, you can buy more bonds or sell stocks. This helps you keep your risks in check even when times are good.

A good rule of thumb to analyze your risks is to subtract your age from 110. The difference would be the percentage you can invest in stocks. For instance, if you are 32 years old, here’s how much money you can invest in stocks:

= 110 – 32

= 78

Assuming your finances are stable, you can dedicate up to 78 percent of your portfolio in stocks.

A well-known story in the Christian Bible illustrates the necessity of risk in investing. In the Parable of the Talents, a rich man leaves his servants with generous sums of money. He entrusts them to build wealth on his behalf. Two of the servants invested their money and made a large profit. One buried the money in the ground.

Upon the benefactor’s return, he is amazed at the profits made by his two wise servants. However, he fired the servant who buried the money. Had the servant placed it in the bank, as his benefactor angrily suggested, he would have made some money from interest with little risk. By playing it too safe, he ended up with nothing.

Be smart with how you save and spend your money. Be prepared to make the hard spending decisions necessary to bolster your savings. As time goes by, make smart decisions about your investments based on an honest assessment of your situation.

Find cheaper alternatives for your daily expenses whenever you can. For instance, paying for a single video-on-demand service might be cheaper than having cable TV with channels you don’t really watch. Do this for both your needs and wants, but don’t be too cheap on yourself either. Buy for quality you can get for less.

You’re never too young to learn the value of smart saving. Encourage your children to start saving for their wants as early as now. Teach them clear goal-setting to help them achieve their dreams. Starting early helps them commit these techniques to habit, which will serve them well in the long run.

Make it your first goal to secure yourself and your family. In the interim, work on your budget to improve your cash flow. Once you’ve saved an emergency fund, put your debts on the chopping block. You can use the money you saved from clearing these bills to speed up your savings goals.

Want to know how much your future home or car will cost you? Check out our mortgage and auto loan calculators.

Jose Abuyuan is a web content writer, fictionist, and digital artist hailing from Las Piñas City. He is a graduate of Communication and Media Studies at San Beda College Alabang, who took his internship in the weekly news magazine the Philippines Graphic. He has authored works professionally for over a decade.