Savings Goals

Net Worth

Compound Interest Calculator

Compound Interest CalculatorThis calculator helps savers estimate their future savings & interest income at various compounding intervals based on a one-time deposit, a regular stream of deposits, or a combination of the two.

To calculate the future value of a monthly investment, enter the intial balance, the monthly dollar amount you will to deposit, the interest rate you expect to earn, and how long you plan to make monthly deposits. The calculator will return the APY associated with your APR along with an estimate of your savings at the end of the investment period. This calculator does not account for the impacts of inflation or personal income taxes.

Guide published by Joelle Jacinto on December 18, 2019

You have probably heard of “the magic of compound interest.” If you deposit any amount in a savings account and forget about it for a few years, you will find that it has grown on its own. It does sound like magic, right?

A person who deposits $1,000 into a bank at an annual percentage rate (APR) of 2% will earn about $20 interest in a year. This is how simple interest works. Interest is calculated only on the principal; in this case, your initial deposit.

Compound interest is interest paid on that $1,020. On subsequent years your bank will pay interest on the full amount, with prior interest acting as principal. In the second year that’s only a compounding of 40 cents, but it still grows if it continues for several years. Simple interest paid on $1,000 for five years will grow into $1,100. But if interest compounds, the balance becomes $1,104.08. In ten years, compounding interest can give you $1,218.99. Instead of an extra 40 cents, $18.99 of compound interest was earned.

| Initial deposit | Time in bank | Your total deposit | Compound interest | Total balance |

|---|---|---|---|---|

| $1,000.00 | 1 year | $1,000.00 | $20.00 | $1,020.00 |

| 2 years | $1,000.00 | $40.40 | $1,040.40 | |

| 5 years | $1,000.00 | $104.08 | $1,104.08 | |

| 10 years | $1,000.00 | $218.99 | $1,218.99 |

This may not sound so magical at the moment, but consider if you made regular deposits. A higher balance earns more interest.

Let’s say you made a monthly $10 deposit, still with your initial deposit of $1,000, compounding interest annually at 2%. In five years, you would earn $128.57 in interest, and $332.96 in ten. So, in ten years, if your deposits total to $2,200.00, its compounded future value will be $2,532.96. That’s $332.96 that you earned only by keeping your money in the bank.

| Initial deposit | Time in bank | Your total deposit | Interest earned | Total balance |

|---|---|---|---|---|

| $1,000.00 | 1 year | $1,120.00 | $20.00 | $1,140.00 |

| 2 years | $1,240.00 | $42.80 | $1,282.80 | |

| 5 years | $1,600.00 | $128.57 | $1,728.57 | |

| 10 years | $2,200.00 | $332.96 | $2,532.96 |

Now, for example, you deposited $100 instead of $10, your compounded balance in ten years will be $14,358.66, making $1,358.66 over your total deposit balance of $13,000.00.

Of course, this only applies if you do not withdraw the money or transfer it to other accounts. Interest is earned on the balance, so the returns change if your balance is different. These figures also do not take into account taxes and inflation.

Compound interest also applies to credit cards and other revolving debts where the balance grows. Mortgages and other debts with a fixed repayment schedule do not incur compound interest because the balance is paid down over time.

Adjusting deposit amounts, APR, and compounding frequency shows how compound interest works. Running simulations can be helpful when opening a savings account, a CD or applying for a credit card.

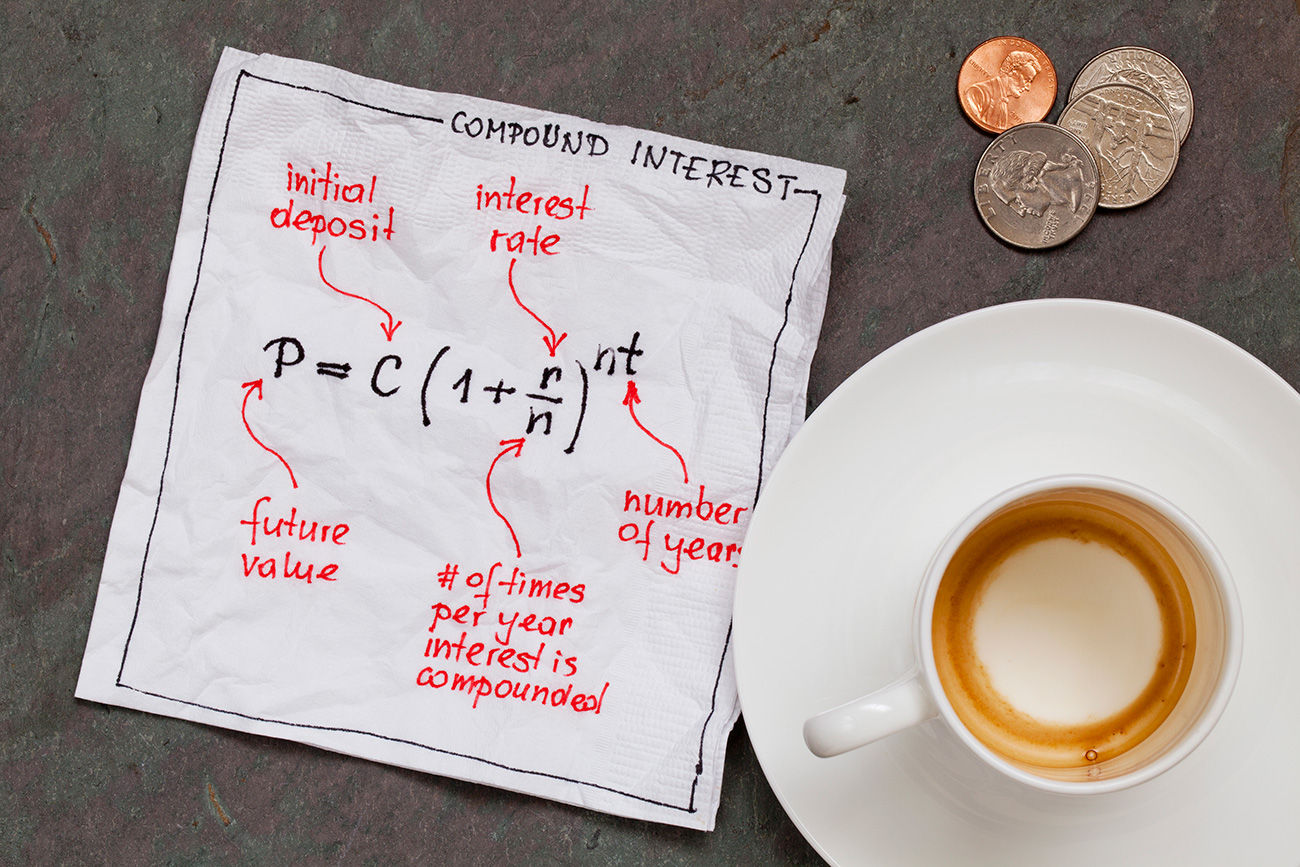

The formula for compound interest is:

P = C (1 + r⁄n ) nt

To calculate this formula, you should know these variables:

You can quickly calculate compound interest using the above calculator. Any calculator with exponential functions or storage functions would also work.

Banks often advertise high annual percentage yields to attract customers to open a savings account. Annual Percentage Yield (APY), also known as Earned Annual Interest (EAR) is the rate of return for the year. Unlike APR, APY accounts for how frequently interest is compounded. The APY relies on interest rates and how often the interest compounds.

Banks often calculate and pay interest at specific intervals. The most common options are:

Adding interest frequently causes your savings to grow faster. If your APR is 2% and your interest compounds annually, then you are paid 2% once a year. Iff your interest compounds quarterly, then .5% is paid four times a year. This means that the interest paid on the second quarter will include interest earned on the interest paid in the first, as it compounds. At high interest rates - like those charged on a credit card - daily compounding can make a big difference. Accounts earning a lower rate of interest - like a passbook savings account - won't see as much impact from frequent compounding.

The following table highlights the impact of interest earned over 5 years on a $10,000.00 initial deposit at 2% APR.

| Frequency | APR | APY | Interest | Savings |

|---|---|---|---|---|

| Annual | 2% | 2.000% | $1,040.81 | $11,040.81 |

| Quarterly | 2% | 2.010% | $1,048.96 | $11,048.96 |

| Monthly | 2% | 2.018% | $1,050.79 | $11,050.79 |

| Daily | 2% | 2.020% | $1,051.68 | $11,051.68 |

You may also use the above calculator to check APY for other frequencies, such as semi-annual, bi-monthly, bi-weekly, weekly and even hourly.

The few dollars raised by compounding daily may not seem much for smaller savings amounts, but if your investment is in six figures or the APR is higher, compounding frequency is a more important consideration.

When comparing banks look at fees, minimum balance requirements, and verify they are backed by the FDIC or the NCUA.

Best banks to open a savings account based on APY

Here are some banks which offered relatively high interest rates in December 2019.

Fitness Bank is not a traditional bank. As its name suggests, it urges its customers to achieve both goals of living a healthy and wealthy lifestyle. They offer several rates, but each rate is attached to a step goal that you must first accomplish. If you can reach a Step Goal of 4,999 steps (monitored by their Fitnessbank Step Tracker app, they offer .50% APY and .50% APR. The rates go up as your steps increase, up to 2.30% APY and 2.28% APR with 12,500 steps.

Aside from achieving a step goal, there is a $100 minimum initial deposit, and you need to be 18 years+. They also have a $10 maintenance requirement, but interest is only earned on balances over $100. They also offer free online banking and external account transfers.

CFG Bank offers certificates of deposit and money market accounts. Certificates of deposit, or CDs, are time-bound deposits, where you make an inital deposit which you cannot add to or withdraw for a period of time. Their 60-month CD account offers an APY of 2.65%. Online money market accounts do not offer check-writing privileges and have withdrawal limits. Their online high yield account that offers 2.30% APY and 2.27% APR has a minimum initial deposit of $1,000, and requires a daily balance of $25,000 to get their best APY.

SFGI Direct has the highest APY at 2.27% without minimum balance requirement, fees or monthly service charge. It is the online component of Summit Community Bank.

State Bank of India in Chicago offers a 2.25% for only $500 minimum balance on US-based consumer savings accounts. They also offer checking accounts, money market accounts and CDs.

Customers Bank is an online only bank that offers a 2.25% APY for accounts with balances of $25,000. They do not require a minimum balance, but accounts with balances lower than $25,000 do not earn interest.

Joelle sees writing as a craft, and is genuinely interested in the topics she tackles, which have ranged from finance and transportation, to pop music, to business advice, to society and culture, to performing arts. She has a Master's in Art Theory and Criticism from the University of the Philippines and is pursuing a PhD in Philippine Socio-Cultural Studies. Her works have been published in broadsheets, lifestyle magazines, online portals and academic journals. Her performing arts reviews have been published in Malaya, Manila Times, Critics Republic, Malaysia, and RealTime Arts, Australia, while her academic work appears in The Borneo Journal and the Journal for the Anthropological Study of Human Movement.